- Sony’s Soneium blockchain froze Aibo and Toro memecoins due to unauthorized use of its intellectual property.

- The decision wiped out $3.8 million in combined market value, sparking investor backlash and accusations of “rugging.”

- Soneium plans to implement a grace period for future blacklisting, giving developers time to address potential issues.

Within hours of its launch on Tuesday, Sony’s new Soneium blockchain found itself in hot water, freezing two memecoins—Aibo and Toro—and leaving investors frustrated. The decision has sparked criticism, costing users thousands of dollars and igniting debate about Soneium’s centralized approach.

Memecoins Frozen: What Happened?

Reports began surfacing at 4 a.m. London time in the Soneium Discord channel, where users discovered they could no longer trade the Aibo and Toro memecoins. On Blockscout’s Soneium explorer, both tokens were labeled as “Forbidden,” with transaction data wiped clean.

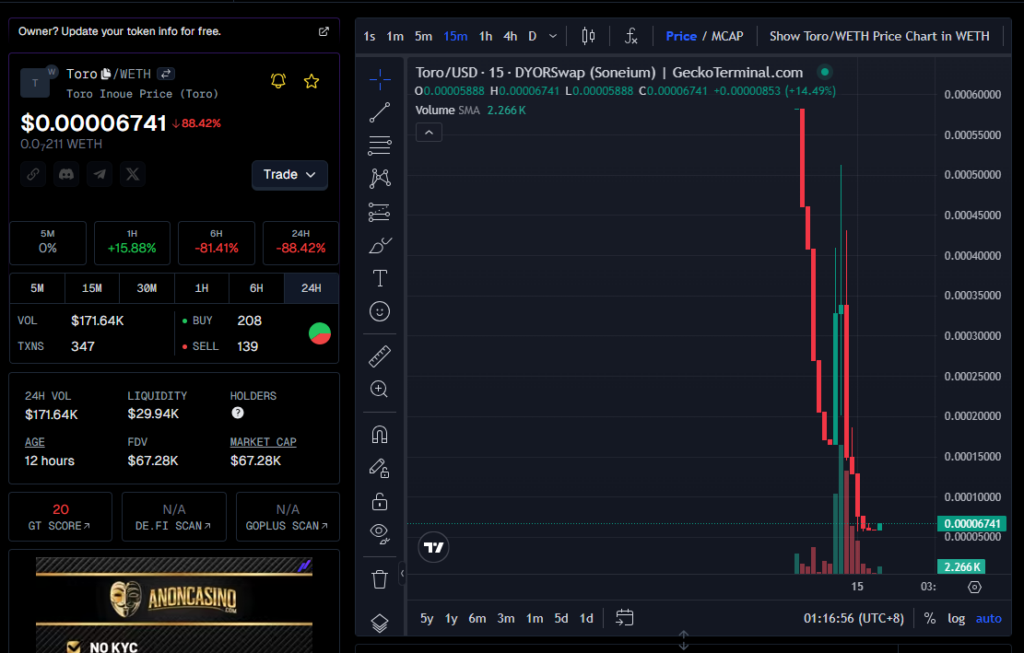

The issue? Unauthorized use of Sony’s intellectual property. Aibo references Sony’s robotic dog series, while Toro nods to Toro Inoue, Sony’s beloved cat mascot. Before the freeze, Aibo had a market value of $2.7 million, while Toro was worth $1.1 million.

Sony Prioritizes IP Protection Over Memecoins

In a statement to DL News, a spokesperson for Sony Block Solutions Labs (BSL) explained the decision:

“Measures were put in place to safeguard the rights of IP holders. In cases where Sony’s IP was used without authorization, swift action was necessary to uphold our mission of protecting creators’ rights.”

This stance contrasts sharply with the typical memecoin-friendly environment on blockchains like Solana, where copyrighted material is often used freely and legal enforcement is challenging due to decentralization. However, Soneium’s centralized architecture gives Sony the ability to freeze tokens at will, a feature that’s both controversial and unique.

Investor Fallout: Claims of “Rugging”

The decision has drawn backlash from investors, some accusing Sony of “rugging” them—a term in crypto that describes a sudden and deliberate action that causes a token’s value to crash. In this case, Soneium’s token freeze effectively wiped out the memecoins’ market value, leaving holders with nothing.

To address these concerns, Sony BSL announced plans to introduce a grace period for future blacklisting decisions. This would give developers time to address issues, such as unauthorized IP use, before any tokens are frozen.

The Bigger Picture: Soneium’s Vision and Challenges

Soneium, built as an Ethereum Layer 2, aims to protect creators’ content rights while fostering creativity and profit-sharing. Despite these lofty goals, the crackdown on memecoins has raised concerns among DeFi enthusiasts accustomed to the freedom of more open blockchains.

Sony remains optimistic about the platform’s future. In their words:

“We do not foresee this issue impacting Soneium’s growth.”

Still, with its unique approach to IP enforcement, Soneium may face an uphill battle in winning over the crypto community while maintaining its mission to protect creators.