- Bitcoin slips below $90,000 but could see a rebound fueled by Trump’s presidency.

- CoinCodex predicts BTC may hit $122,056 by January’s end, a 32.5% jump.

- Trump’s promised BTC reserve and crypto integration could trigger long-term growth.

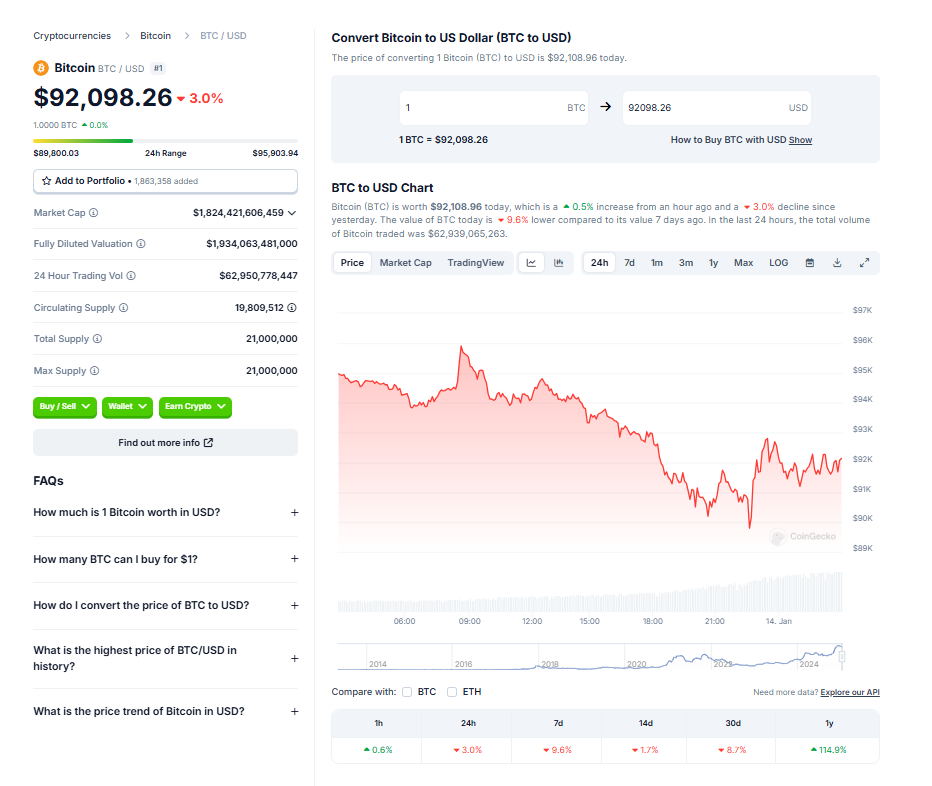

The cryptocurrency world was caught off guard earlier this week when Bitcoin (BTC) dropped below $90,000, marking a rough start to 2025. This decline has left many wondering if a rebound is on the horizon, especially as President-elect Donald Trump prepares to take office. Could this political shift inject new energy into Bitcoin’s performance?

Over the first 13 days of January, BTC’s underwhelming performance has disappointed many investors. CoinShares analysts even remarked that the “post-US election honeymoon is over.” But with Trump’s imminent return to the White House, some believe Bitcoin could see a significant boost.

Bitcoin’s Recent Performance: A Snapshot

Bitcoin has been in a bit of a slump. Over the past month, the leading cryptocurrency has fallen by 9.45%, with an 8% drop just in the last week. It’s currently trading near $91,800, bouncing slightly from its recent low of $89,000.

Yet, optimism remains. According to CoinCodex, Bitcoin could climb to an average price of $107,000 by the end of January. Even more impressively, they predict BTC will hit an all-time high of $122,056 before the month is over. If this projection proves true, Bitcoin would see a 32.5% increase from its current price.

Trump’s Role in Bitcoin’s Potential Surge

Trump’s return to the White House may have significant implications for Bitcoin. His campaign promises included establishing a strategic BTC reserve, which could lead to a surge in demand and a sharp rise in Bitcoin’s value. Additionally, Trump has expressed interest in further integrating Bitcoin into the U.S. economy, potentially creating long-term benefits for the cryptocurrency market.

Final Thoughts: A Turning Point for Bitcoin?

While Bitcoin’s start to the year has been lackluster, the combination of market predictions and Trump’s policies could bring a much-needed boost. With a potential all-time high on the horizon and increased integration into U.S. strategy, Bitcoin’s future in 2025 looks anything but dull. For now, all eyes are on the market—and the White House.