- Timothy Peterson predicts Bitcoin will hit $1.5 million by 2035, based on Metcalfe’s Law.

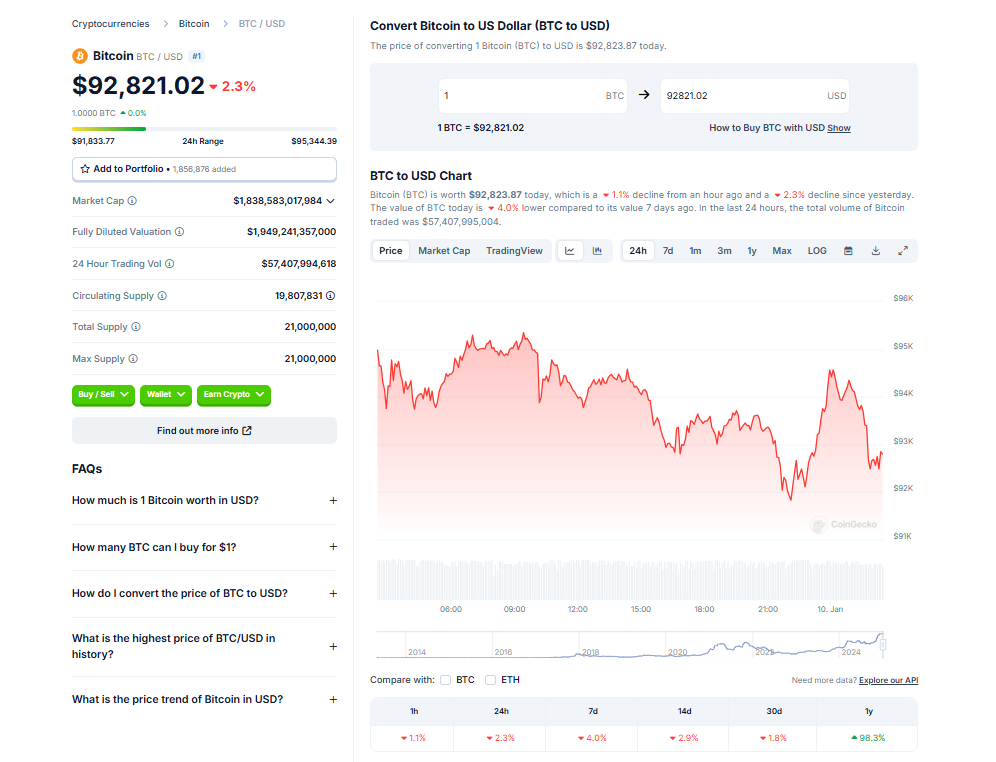

- Short-term Bitcoin dips could deepen, with key levels around $86,500 and $77,900 in focus.

- Peterson’s past predictions, like Bitcoin staying above $10K, have been remarkably accurate.

In a bold prediction that has the crypto world buzzing, Timothy Peterson, a renowned network economist, has doubled down on Bitcoin’s bullish future. On January 8, Peterson took to social media platform X to unveil his eye-popping forecast: Bitcoin could hit a staggering $1.5 million per coin within the next decade.

“The year is 2035. Bitcoin is at—and you can hold me to this—$1.5 million,” he wrote in his post. To add a touch of humor, he added, “And somewhere, someone is asking, ‘Is now a good time to buy Bitcoin?’”

The Method Behind the Madness

Peterson’s ambitious price target isn’t just a random guess. It’s grounded in a model he developed based on Metcalfe’s Law, which links network expansion to Bitcoin’s value. His 2018 paper, Metcalfe’s Law as a Model for Bitcoin’s Value, argued that Bitcoin’s global adoption would naturally drive its price upward.

“Traditional currency models fail with Bitcoin,” the paper explains. “But various mathematical laws that explain network connectivity offer a compelling explanation of its value.”

Peterson’s track record for accurate predictions also adds weight to his latest claim. Back in 2020, his Lowest Price Forward indicator correctly forecasted that Bitcoin wouldn’t dip below $10,000 again. More recently, he pinpointed a local price bottom in September 2022—within just eight days of its occurrence.

A Cooling Market—For Now

While Peterson’s long-term outlook is wildly optimistic, the short-term picture for Bitcoin remains murkier. The fourth quarter of 2024 saw less-than-stellar performance, with Peterson calling it the “second-worst ‘up’ quarter out of the past 10.” In a January 2 post, he described Bitcoin’s recent action as “nothing special.”

Meanwhile, other market watchers are offering mixed takes on where BTC might be headed in 2025. Some anticipate a deeper price correction, with targets potentially dropping near previous all-time highs of $73,800. On the flip side, optimists expect a return to upward momentum as new global events, like the inauguration of the next U.S. president, could provide a boost.

Is the Dip Over, or Just Beginning?

Keith Alan, co-founder of trading resource Material Indicators, weighed in with a cautious outlook. “TLDR: This dip isn’t done dipping,” he told his X followers on January 9. Alan pointed to suppressed price action and suggested that buyers are likely waiting for even lower levels to jump back in.

Alan speculated that a correction to $86,500 would represent a 20% drop from Bitcoin’s all-time high of $92,000. If that support level doesn’t hold, he warned, the CME Gap at $77,900 could come into play.

“There’s no telling whether this move will develop into the deep correction we’ve been expecting,” Alan admitted. But for now, traders are bracing themselves for more turbulence.

Bitcoin’s journey to $1.5 million may be less than a decade away, but the path there is sure to be a bumpy ride. Whether Peterson’s bold prediction pans out remains to be seen, but one thing is certain: the world’s largest cryptocurrency continues to defy expectations and captivate imaginations.