- Standard Chartered launches a Luxembourg entity to provide Bitcoin and crypto custody services in the EU.

- The move aligns with growing institutional interest in digital assets after a historic year for crypto.

- Zodia Custody, backed by Standard Chartered, leads the initiative with experienced leadership in place.

Big news for the crypto world: Standard Chartered is officially entering the European Union (EU) crypto space. The $870 billion asset management giant has reportedly set up a new entity in Luxembourg to offer Bitcoin and crypto custody services. This development, first reported by Reuters, marks a significant milestone for the traditional banking heavyweight.

Meeting the Growing Demand for Digital Assets

Standard Chartered’s move isn’t just about jumping on the bandwagon—it’s about seizing a golden opportunity. According to the report, the bank aims to “cash in on the growing demand for digital security.” And honestly, who could blame them? Crypto’s popularity skyrocketed last year, and institutions everywhere are scrambling to get a slice of the action. Standard Chartered is just one of many financial players looking to solidify their presence in the industry as we step into 2025.

A Natural Progression After a Historic Year for Crypto

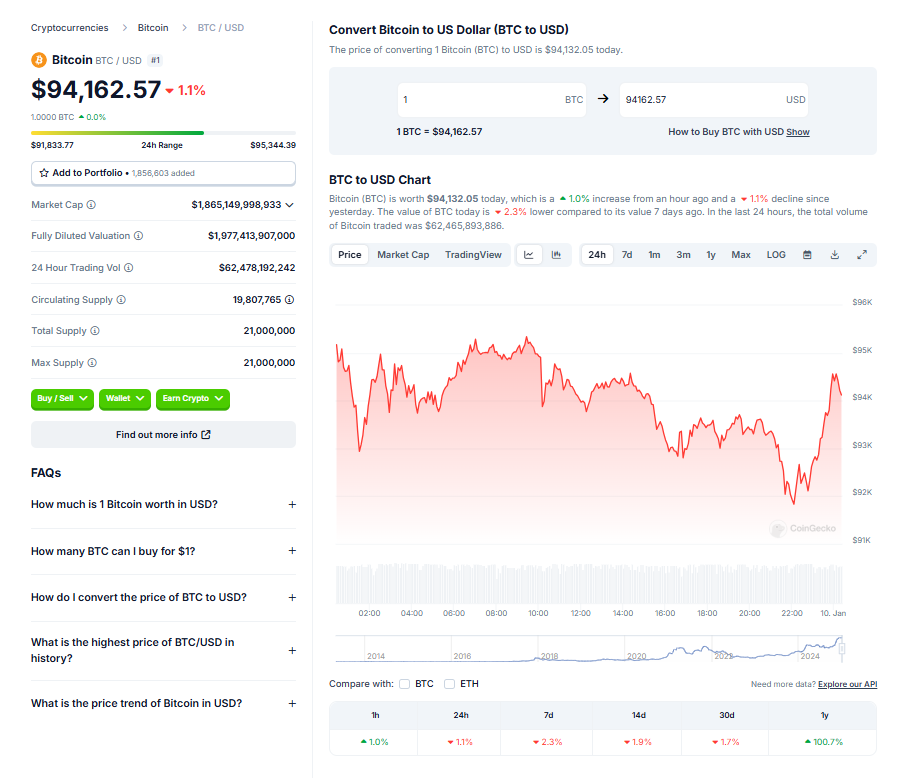

2024 was a whirlwind for the digital asset space. With the introduction of crypto-based ETFs and Bitcoin reaching six-figure valuations for the first time ever, it was a year that turned heads. That success only fueled institutional interest, with more traditional financial entities realizing that crypto is no longer just a niche—it’s a movement.

Now, Standard Chartered has taken a big leap into the sector by offering Bitcoin and crypto custody services in the EU. This new Luxembourg entity builds on their earlier success with similar services launched in the United Arab Emirates (UAE).

Zodia Custody’s Role in the Expansion

The Luxembourg-based initiative ties in closely with Zodia Custody, a crypto custodian owned by Standard Chartered. According to reports, Zodia registered with Luxembourg back in March 2023. The bank also brought in Laurent Marochini—formerly head of innovation at Société Générale—as the chief of this new entity.

This isn’t just a standalone project; it’s part of a bigger picture. Financial giants like Standard Chartered are increasingly looking for ways to position themselves in a market that’s predicted to soar in 2025. With pro-crypto President-elect Donald Trump taking office, the regulatory landscape in the U.S. is expected to shift in favor of digital assets. If that happens, global interest in crypto is likely to grow even further.

A Pivotal Moment for Finance and Crypto

It’s clear that Standard Chartered’s latest move is more than just a business decision—it’s a signal. Traditional finance and digital assets are coming closer together, and this development is a testament to the ongoing evolution of the financial industry. Whether you’re a crypto enthusiast or a cautious observer, there’s no denying that 2025 is shaping up to be an exciting year for digital assets.