- Bitcoin and other major cryptocurrencies like Dogecoin and Solana saw significant price dips, with Bitcoin dropping over 4% in a single day to below $98K.

- The sell-off was triggered by unexpected U.S. economic data, causing investors to rethink their positions on a potential Federal Reserve interest rate cut in 2025.

- About $385 million in long and short positions were liquidated in the past 24 hours, with long positions accounting for $212 million of the total losses.

It’s a rough start to the week for cryptocurrencies, with major assets like Bitcoin, Dogecoin, and Solana seeing significant dips. Early Tuesday, fresh economic data sent shockwaves across both crypto and stock markets, cooling the enthusiasm many investors had just days ago.

Bitcoin Dips Below $98K, Dragging the Market with It

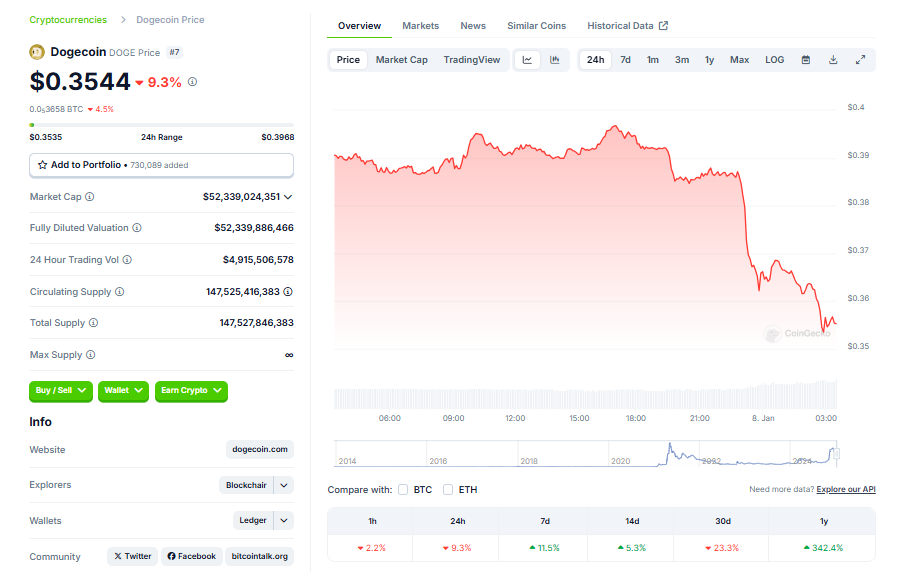

Bitcoin, the biggest player in the crypto world, saw its price drop from nearly $101,000 to a current level of $97,856—a more than 4% dip in a single day. Ethereum and Dogecoin aren’t far behind, both slipping around 7%, while Solana recorded a 6% loss.

The sell-off seems to have been triggered by unexpected U.S. economic data, particularly hotter-than-anticipated job openings numbers. Investors, who were previously banking on a Federal Reserve interest rate cut in early 2025, appear to be rethinking their positions.

Massive Liquidations as Markets Correct

The price drop led to a flurry of liquidations, with about $385 million in long and short positions wiped out in the past 24 hours, according to CoinGlass. A staggering $230 million of that came within the last four hours alone, and long positions took the brunt of it, accounting for $212 million of the total.

The Fed’s Impact on Crypto Volatility

Cryptocurrencies have historically thrived in low-interest-rate environments, given their tendency for volatile price swings. But that dynamic shifted in 2022 when the Federal Reserve aggressively hiked rates to combat inflation post-COVID-19, making risky assets like Bitcoin less appealing.

Last year, the crypto market rebounded as the Fed eased up, sparking a rally not just in Bitcoin but also in traditional equities.

Arthur Hayes Warns of a March Market Peak

Former BitMEX CEO Arthur Hayes recently suggested in an essay that the crypto market could peak by mid-March before facing a “severe” correction. Drawing an unusual parallel, Hayes likened the early snowfall in Japan’s ski resorts to crypto markets reacting prematurely.

Bitcoin’s Record High and Trump’s Win

In December, Bitcoin hit a historic high of $108,135, buoyed by Donald Trump’s presidential victory and the long-awaited approval of spot Bitcoin ETFs in the U.S. However, the Federal Reserve’s cautious stance has tempered some of that excitement. Chair Jerome Powell recently warned that while the Fed may adjust rates, they’ll be doing so with “greater caution” moving forward.

Looking Ahead

With the Fed signaling a careful approach and economic data clouding the market’s outlook, the crypto space is likely to remain volatile in the weeks ahead. For now, investors seem to be navigating a bumpy ride, unsure of what’s around the next bend.