- Experts believe a Donald Trump administration will rapidly overhaul crypto policy, reinvigorate digital asset innovation, and breathe new life into the legitimate areas of the crypto market, particularly benefiting Ethereum.

- Under Trump, the SEC is expected to undergo major changes, with a more crypto-friendly stance, potentially classifying crypto assets as property, and the CFTC could gain increased oversight over crypto regulation.

- Specific developments that could boost Ethereum include the potential approval of staking yields for Ether ETFs, an end to the SEC’s hostile approach toward DeFi projects, and a more favorable regulatory environment for innovation.

In this article, we delve into the potential impact of a Donald Trump administration on the world of Ethereum and the overall crypto market. Experts believe that such a shift in political power could instigate a rapid transformation of crypto policies and spark a resurgence in digital asset innovation. This rejuvenation could breathe new life into the legitimate sectors of the crypto market and place Ethereum back in the spotlight.

Ethereum’s Underperformance: A Thing of the Past?

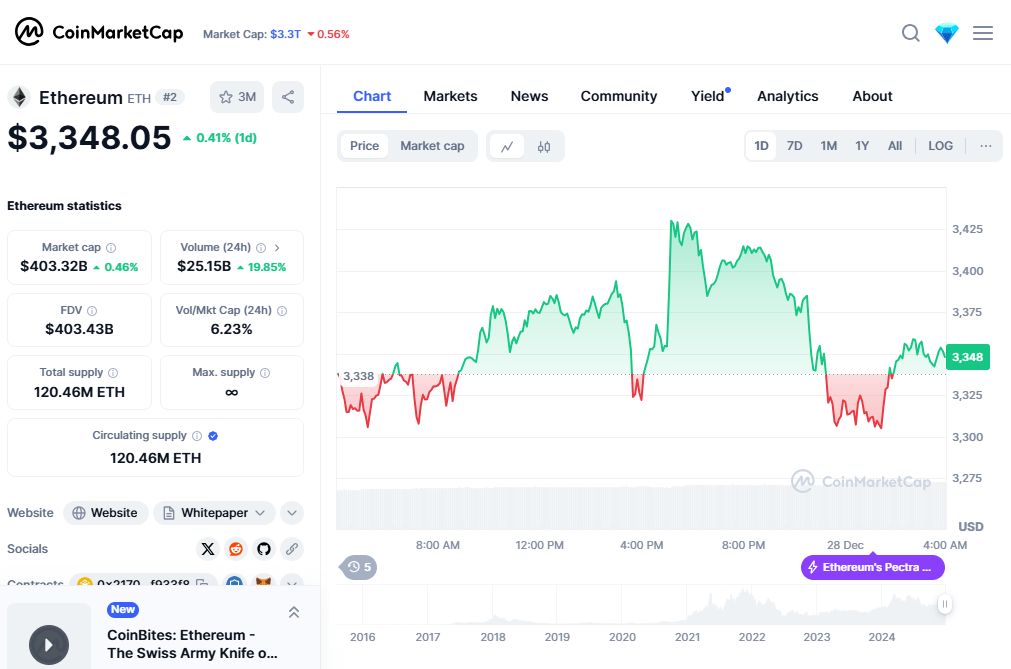

In the past 18 months, Ethereum’s Ether (ETH) has been overshadowed by the stellar performances of Bitcoin (BTC) and various alternative layer-1 coins, such as Solana (SOL) and Sui (SUI). However, with the possible election of Donald Trump and the anticipated crypto-friendly approach of his administration, experts believe that Ether’s time to shine is on the horizon.

How Trump Administration Might Influence Ethereum’s Performance

The Trump administration, with its pro-crypto stance, is expected to stimulate a range of developments that could bolster the performance of ETH in the crypto market. These developments could include the demise of financial nihilism, a complete overhaul of the US Securities and Exchange Commission, positive regulatory developments, Ether exchange-traded fund (ETF) staking, and increased Commodity Futures Trading Commission (CFTC) oversight of crypto.

The Potential Impact of Trump’s SEC Overhaul on DeFi

The crypto-friendly stance of the Trump administration could cause a shift in the industry, with legitimate projects potentially being encouraged by regulators rather than being bombarded with endless Wells notices from the Securities and Exchange Commission (SEC). This could create a more favourable regulatory environment for DeFi projects and foster innovation in the crypto industry.

The Possible Legal Changes Under Trump Administration

The Trump administration’s pro-crypto stance is evident in the launch of the Trump dynasty’s World Liberty Financial which has already invested millions of dollars in Ethereum, Chainlink, and Aave. This move is seen as a soft endorsement of Ethereum, DeFi, and real-world crypto projects.

The Potential for ETH Staking Yields to Come to ETFs

The Trump administration could revisit decisions to block in-kind redemptions for crypto ETFs and consider adding staking for Ether ETFs. This development could be highly beneficial for Ethereum and the overall crypto market.

Conclusion:

The potential election of Donald Trump and the anticipated shift in crypto policies could have a significant impact on the world of Ethereum and the broader crypto market. By fostering a more favourable regulatory environment and making strategic investments in Ethereum and other crypto projects, the Trump administration could stimulate growth in the industry and lead to a resurgence of Ethereum. However, these predictions are speculative and depend on a wide range of factors, including the actual policy decisions made by the Trump administration.