- XRP trades at $2.18, showing a 4.51 percent daily decline.

- Support near $2.10 is crucial to prevent further downward moves.

- Volatility remains elevated, with XRP reacting to market-wide sentiment.

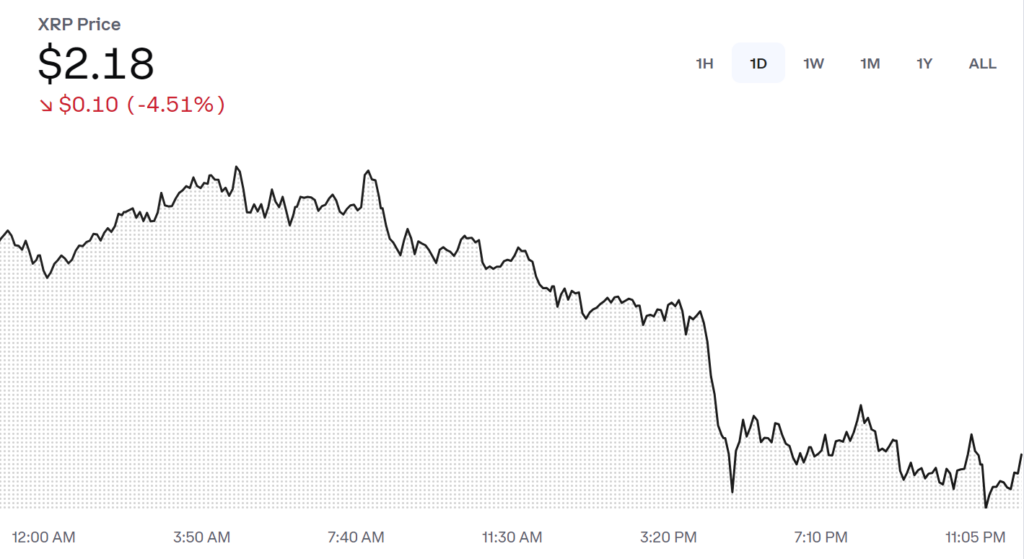

XRP has encountered downward pressure, trading at $2.18 following a 4.51 percent decline over the last 24 hours. The drop highlights the token’s susceptibility to broader market conditions and investor sentiment. After a strong rally earlier this year, XRP appears to be consolidating, with buyers and sellers vying for control within a narrowing range.

The Coinbase chart demonstrates a steady decline throughout the day, with multiple attempts to stabilize above $2.20 proving unsuccessful. Trading volumes remain moderate, suggesting cautious market participation as traders await clearer signals. XRP’s inability to sustain gains near its recent highs could indicate short-term bearish sentiment, although its long-term outlook remains tied to market developments and adoption trends.

Key Price Levels and Technical Indicators

Support at $2.10 has emerged as a pivotal level for XRP, with previous tests at this zone providing a temporary floor. A breakdown below this threshold could expose the token to further losses, potentially targeting the $2.00 mark. Resistance remains firm near $2.30, where selling pressure has repeatedly capped upside momentum.

The chart highlights a descending pattern, with lower highs forming since mid-December. Momentum indicators suggest that XRP may face continued challenges unless it reclaims and holds above its resistance levels. Volatility, a characteristic of XRP’s market behavior, remains high, emphasizing the need for traders to exercise caution.

Broader Market Influence

XRP’s recent price movement reflects broader cryptocurrency market trends, where macroeconomic factors and regulatory developments play significant roles. Recent declines could be attributed to cautious sentiment stemming from external factors impacting digital asset markets.

While XRP’s price struggles to regain upward momentum, its utility and adoption remain points of interest for long-term holders. The token’s ability to recover and sustain gains will depend on its capacity to attract buyers near support levels.

Sustaining above $2.10 would bolster confidence, potentially paving the way for a rebound toward resistance zones. Conversely, a failure to hold this level could signal further downside, testing the resilience of its broader market support. XRP’s trajectory in the coming weeks will likely hinge on broader market sentiment and its ability to weather current pressures effectively.