- The U.K.’s Financial Conduct Authority (FCA) issued a public notice against Solana meme coin Retardio

- Retardio holders celebrated a 16% price surge on the news

- The FCA plans to ban unregulated firms from providing crypto services in the UK by 2025

In a surprising turn of events, the United Kingdom’s Financial Conduct Authority (FCA) publicly cautioned against the Solana meme coin Retardio. This announcement, though seemingly negative, led to a 16% price surge for the meme coin, leaving its holders in a celebratory mood.

The FCA’s Warning and Its Implications

The FCA, in its public notice dated December 16, 2024, stated that the Retardio project, a Solana meme coin, could potentially be offering or promoting financial services without the necessary regulatory permissions. The implications of this warning are far-reaching. Any investor engaging with Retardio will not be entitled to use the Financial Ombudsman Service, which is the FCA’s complaint resolution channel. Additionally, Retardio investors will not be protected by the Financial Services Compensation Scheme, which safeguards the money of consumers when financial firms fail. The FCA’s notice highlighted that if the firm were to go under, it is highly unlikely that investors would recoup their money.

Retardio’s Market Response and Community Reaction

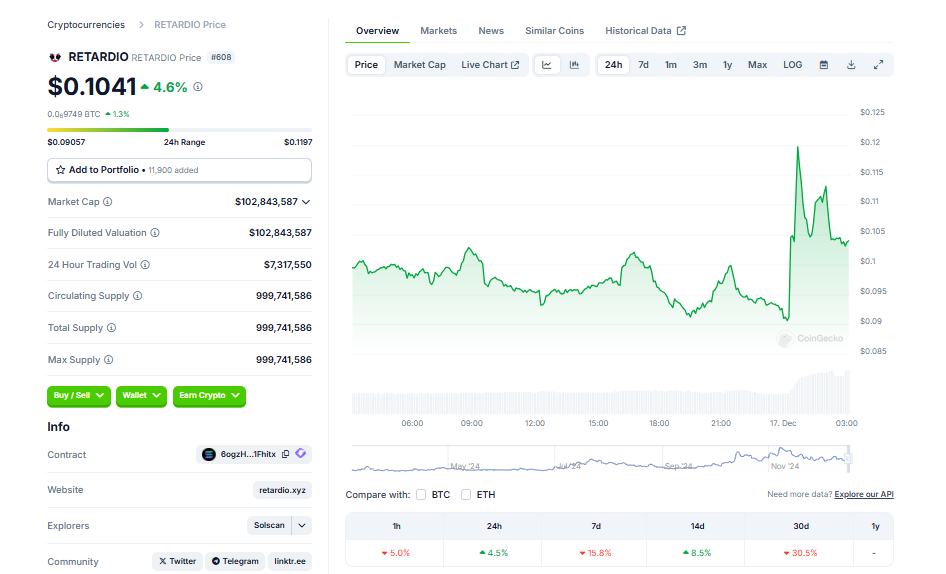

Despite the warning, Retardio, a well-received Solana meme coin, boasts a market cap of 111 million. The coin’s value spiked by 16% following the FCA’s announcement, after previously peaking near 240 million. The Retardio community reacted to the news with a flurry of memes and playful social media posts. A similar notice was issued by the FCA earlier in December against meme coin launchpad Pumpfun, which subsequently restricted UK users’ access to its platform.

FCA’s Increased Crypto Scrutiny and Future Plans

On the same day, the FCA also released a paper proposing stricter regulations on public cryptocurrency offers. The regulatory body plans to prohibit unregulated firms from providing services and expand on the 2023 ban on digital asset promotions targeting UK investors. The UK authorities aim to implement these crypto regulations by 2025. Stablecoins and staking are expected to fall under the new policies’ purview. Thought leaders in the space, like On Chain partner Brett Hillis, have called for standardization of Britain’s digital asset frameworks, particularly in the wake of Donald Trump’s re-election. The UK government currently holds over 6 billion in Bitcoin, mostly from criminal seizures.

Conclusion

The intensified scrutiny by the FCA indicates a more rigorous regulatory climate for cryptocurrencies in the UK. While the immediate market response to the FCA’s warning about Retardio was a price surge, the long-term implications of the increased regulatory oversight on meme coins and other cryptocurrencies remain to be seen. As the regulatory landscape shifts, investors and stakeholders in the crypto space need to stay informed and adjust their strategies accordingly.