- JPMorgan raised price targets for Bitcoin mining stocks MARA Holdings, CleanSpark, Riot Platforms, and IREN to reflect the value of their electrical power assets and Bitcoin treasuries.

- The analysts incorporated a “HODL premium” for miners holding Bitcoin on their balance sheets, similar to MicroStrategy’s premium valuation.

- Riot Platforms has the most valuable power portfolio among the covered miners, worth an estimated $1.3 billion according to JPMorgan.

In a recent move, JPMorgan has revised its price targets for four Bitcoin mining stocks. This action was taken to reflect the value of these companies’ electrical power assets and Bitcoin (BTC) holdings. The companies that have seen upgrades include MARA Holdings, CleanSpark, Riot Platforms, and IREN.

Changes in Valuation Criteria and HODL Premiums

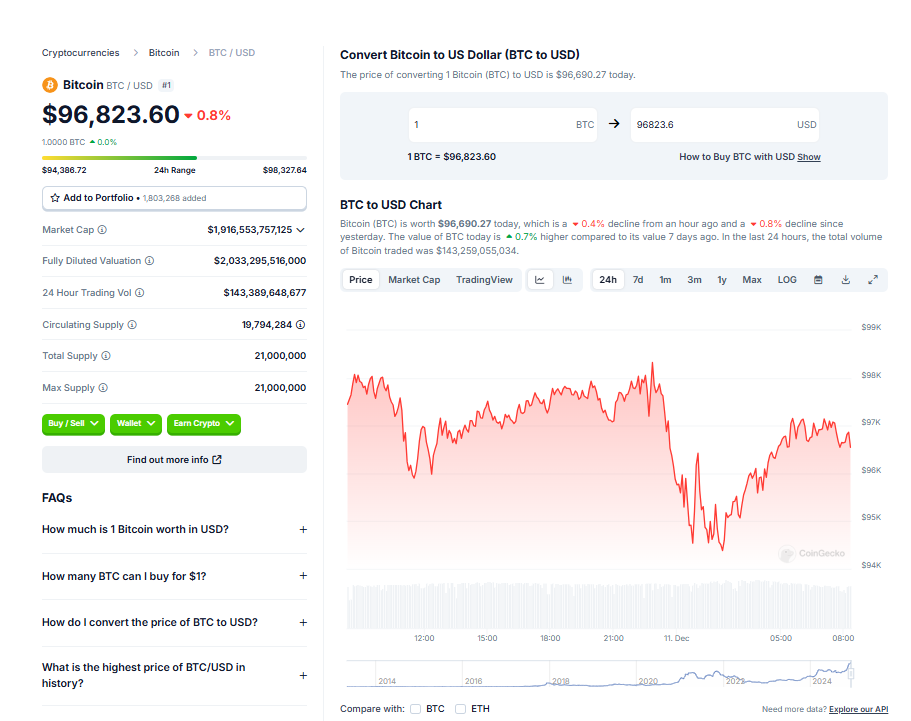

Previously, JPMorgan valued Bitcoin miners based on the four-year gross profit opportunity for each operator. Now, this framework has been expanded to include the value of each company’s land and power assets, as well as a HODL premium. This premium credits miners for holding Bitcoin on their balance, similar to MicroStrategy. MicroStrategy, a software company that has become a de facto Bitcoin fund, trades at a roughly 24x multiple to the value of its Bitcoin treasury. As of December 10, MicroStrategy’s stock had gained nearly 450% year-to-date, surpassing Bitcoin’s 125% gains.

Corporate Bitcoin Treasuries and the Role of Miners

MicroStrategy owns the world’s largest corporate Bitcoin treasury, worth approximately $40 billion. It is closely followed by major Bitcoin miners like Marathon, Riot, and CleanSpark. These companies hold Bitcoin treasuries valued at approximately $3.9 billion, $1.1 billion, and $890 million respectively. Now, many companies are purchasing Bitcoin with the hope of earning a similar trading premium in the public markets. As of December 10, corporate treasuries held more than $5.3 billion in Bitcoin.

Power Acquisitions and the Mining Landscape

Bitcoin miners have been working to adapt to the Bitcoin network’s April 20 halving event, which reduced mining rewards from 6.25 Bitcoin to 3.125 Bitcoin per block. This event, coupled with lower margins and profitability, led cash-rich mining companies like Riot Platforms and CleanSpark to acquire other miners with turn-key facilities to increase near-term hashrate and improve their power pipeline. The recent report from JPMorgan suggests that Riot has the most valuable power portfolio, estimated to be worth $1.3 billion.

Conclusion

The recent moves within the Bitcoin mining industry indicate a dynamic landscape, with major players constantly adapting to changes and seeking new ways to increase profitability. As the Bitcoin network evolves, these companies continue to strategize, ensuring they remain competitive and maintain their position within the market.