- MicroStrategy acquired another 21,550 BTC at an average price of $98,783 per BTC last week amid Bitcoin briefly surging past $100,000.

- MicroStrategy co-founder and chairman Michael Saylor said he would still be buying Bitcoin at $1 million per coin.

- Saylor urged the United States government to dump gold reserves and buy more Bitcoin as a hedge against inflation.

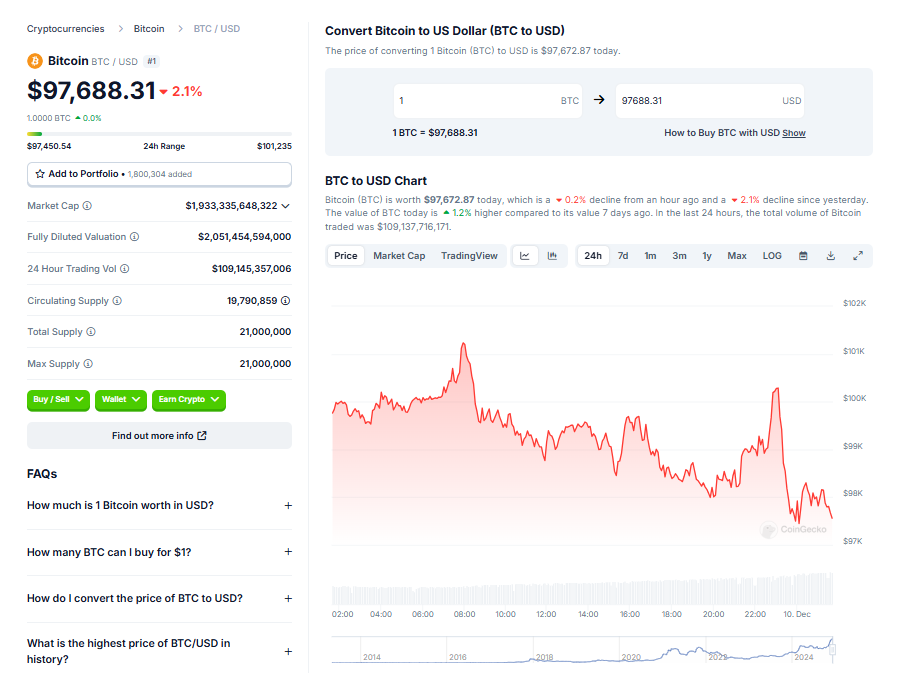

MicroStrategy, a prominent corporate holder of Bitcoin (BTC), continues to augment its BTC stockpile despite the cryptocurrency’s recent surge to unprecedented high prices. The company recently acquired an additional 21,550 BTC at an average price of $98,783 per BTC. This move comes amid BTC’s brief surge past the $100,000 mark, affirming MicroStrategy’s unwavering faith in the future of the digital asset.

MicroStrategy’s Bold Bitcoin Acquisition

From December 2nd to 8th, MicroStrategy purchased an additional 21,550 BTC, spending roughly 2.1 billion dollars. This acquisition brought the company’s total Bitcoin holdings to 423,650 BTC, which were obtained for a cumulative amount of 25.6 billion dollars at an average cost of $60,324 per BTC. MicroStrategy’s co-founder, chairman, and former CEO, Michael Saylor, announced this latest acquisition, reinforcing the company’s commitment to Bitcoin.

Saylor’s Unwavering Confidence in Bitcoin’s Future

Despite Bitcoin reaching new all-time highs and breaking the $100,000 barrier for the first time on December 5th, Saylor maintains his bullish stance on the cryptocurrency. He confidently stated, “I’m sure that I will be buying Bitcoin at 1 million a coin, probably 1 billion dollars a day of Bitcoin at 1 million a coin.” His bold statements were made during an appearance on Yahoo Finance‘s Market Domination.

Saylor’s Advocacy for Bitcoin over Gold

In addition to his robust support for Bitcoin, Saylor has also urged the United States government to divest from gold reserves and invest more in Bitcoin as a hedge against inflation. He suggests selling all US gold to buy Bitcoin, arguing that this would effectively demonetize the gold asset class. As Saylor sees it, this move could potentially elevate the nation’s assets to a hundred trillion dollars while diminishing the value of gold held by adversaries.

Conclusion

In conclusion, MicroStrategy’s latest Bitcoin acquisition, along with Saylor’s bullish predictions for the cryptocurrency’s future, reinforces the company’s long-term commitment and belief in the potential of digital assets. Regardless of market fluctuations and BTC’s current high prices, the company continues to invest heavily in Bitcoin, firmly believing in its future value and potential as a hedge against inflation.