- Spot Ether ETFs recorded $224.9 million in net inflows compared to $35.2 million for Bitcoin ETFs.

- Ethereum prices climbed 7.7% after a court win for Tornado Cash and reports of a potential regulatory shift.

- Leveraged Ether ETF demand rose 160%, reflecting growing investor confidence in Ethereum’s ecosystem.

Spot Ether exchange-traded funds (ETFs) have outperformed their Bitcoin counterparts in weekly net inflows, reflecting increasing investor interest in Ethereum’s ecosystem. From November 22 to 27, Ether ETFs attracted $224.9 million, significantly outpacing Bitcoin ETFs, which saw $35.2 million in inflows during the same period, according to Farside Investors.

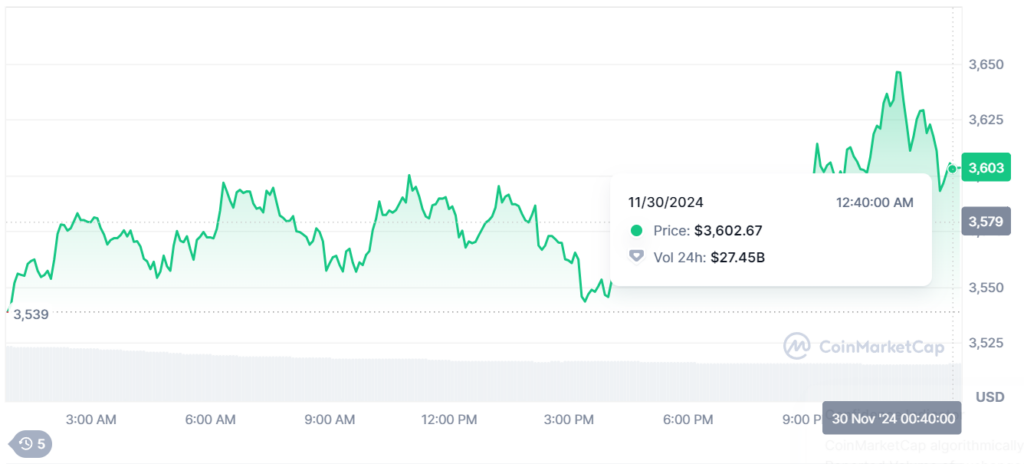

Ethereum’s price has risen by 7.7% over the past week, reaching $3,590, buoyed by two major developments. A U.S. court decision partially favoring Tornado Cash, a decentralized privacy protocol built on Ethereum, and speculation about regulatory leadership changes have contributed to renewed investor confidence. Reports suggest that Paul Atkins, a crypto-friendly advocate, could replace current SEC chair Gary Gensler under the incoming Trump administration, potentially ushering in a more favorable regulatory landscape for blockchain projects.

Bitcoin Slows as Ethereum Gains Momentum

While Bitcoin ETFs experienced record-breaking monthly inflows of $6.2 billion in November, including $3.1 billion last week alone, their performance slowed during the past week. Bitcoin’s price dropped by 2% to $96,780, bringing the ETH-to-BTC price ratio up to 0.037 BTC, its highest in weeks.

Markus Thielen, founder of 10x Research, attributed Ethereum’s rally to its position as the leading blockchain for decentralized finance (DeFi). He noted that Tornado Cash’s court victory underscores Ethereum’s growing relevance in privacy and DeFi applications. Additionally, expectations of regulatory changes under the new U.S. administration are positioning Ethereum as a key player in the next phase of blockchain development.

Reports also indicate that Ether could act as a “catch-up trade,” given that it has trailed behind Bitcoin and Solana in the current market cycle. Leveraged Ether ETFs have seen a 160% rise in demand since November 22, further emphasizing the growing investor confidence in Ethereum’s potential for growth.

Ethereum’s positioning as both a technological leader and a regulatory beneficiary has placed it at the center of investor attention, with experts forecasting continued momentum heading into 2025.