- Fresh capital from retail investors is critical for altcoins to reach new all-time highs, analyst Ki Young Ju explains.

- Institutional investors are unlikely to rotate gains from Bitcoin or Ether into smaller altcoins, requiring independent growth strategies.

- Signs of retail investor FOMO include rising open interest in Ether futures and increased MicroStrategy share purchases.

The altcoin market may need an influx of retail capital to reach new all-time highs, according to CryptoQuant CEO Ki Young Ju. The quantitative analyst recently explained that institutional funds are largely tied up in exchange-traded funds and are unlikely to move from established assets like Bitcoin and Ether into smaller altcoins.

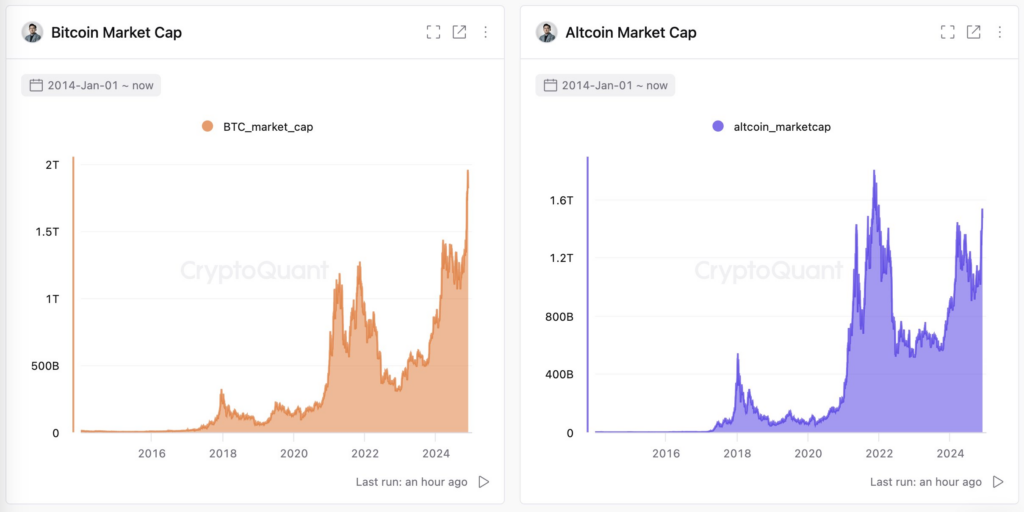

Ju highlighted the current gap between the altcoin market cap and its previous peak, noting that fresh liquidity is crucial for a sustained rally. He urged altcoin projects to focus on unique strategies for attracting capital rather than relying on Bitcoin’s momentum. Despite these challenges, Ju remains optimistic about the future potential of altcoins.

Retail FOMO and Market Trends Signal Potential Shifts

The role of retail investors has been emphasized as a driving force for future altcoin gains. Ju suggested that reigniting retail fear of missing out (FOMO) will be essential for smaller cryptocurrencies to see significant price increases.

Indicators of growing retail participation include Ether futures open interest reaching a record high on November 27, pointing to increased market activity. Additionally, retail investors have purchased nearly $100 million in MicroStrategy shares over the past week, viewing the company as a proxy for Bitcoin exposure.

Other market analysts, like Willy Woo, have noted that while altcoin seasons may still occur, their intensity could diminish over time. Woo explained that as the market matures, smaller assets may see reduced interest compared to the major altcoin rally of 2017. However, the cyclical nature of market behavior suggests mid-cap and low-cap altcoins could still experience pumps as investors seek higher returns along the risk curve.

The ongoing developments in altcoin strategies and retail participation may set the stage for the next phase of market growth.