- Bitcoin is rapidly approaching the $100,000 milestone, fueled by institutional demand, the launch of Bitcoin ETF options, and growing mainstream adoption

- A potential Bitcoin pullback after crossing $100,000 could trigger an “altseason” where altcoins outperform Bitcoin in terms of percentage gains

- Despite the bullish momentum, market volatility and the risk of sudden price swings remain, highlighting the importance of a balanced and well-researched approach to investing in cryptocurrencies

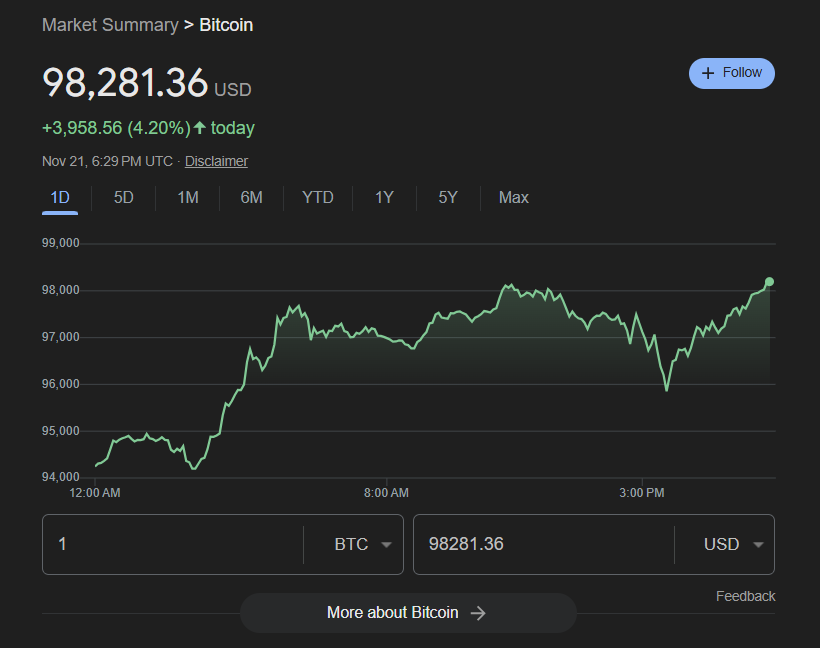

Bitcoin has been smashing records lately, surging past $97,000 and hitting an all-time high of $98,350. This incredible bull run has been fueled by a surge of institutional money into Bitcoin-focused ETFs, as well as growing optimism around crypto regulation and adoption. As Bitcoin edges closer to the $100k milestone, excitement is reaching a fever pitch. But will this momentum continue, or is a correction looming?

Bitcoin’s Meteoric Price Rise

Over the last two weeks alone, Bitcoin has climbed a jaw-dropping 40%, more than doubling in value this year. On November 21st, it hit an eye-watering $97,000 after reaching an all-time high of $98,350 – a 3% jump in just 24 hours. Analysts attribute much of this surge to Donald Trump‘s recent election victory and his crypto-friendly stance. In response, over $4 billion has flooded into US Bitcoin spot ETFs from institutional investors since the election.

On November 20th, these ETFs logged their third straight day of inflows, pulling in $773.47 million. The past three days have seen total inflows exceeding $1.8 billion according to CoinGlass data. This shows the growing institutional appetite for Bitcoin as regulatory clarity improves.

The Role of Options Trading

While spot ETFs have fueled Bitcoin’s surge, the market-moving impact of options on these funds has added further momentum. When BlackRock’s Bitcoin Trust ETF (IBIT) debuted its options on November 19th, it generated a staggering $19 billion in notional exposure on day one.

The overwhelming interest was in call options, indicating strong bullish sentiment. Moreover, IBIT continued to dominate on November 20th, accounting for 97% of all Bitcoin ETF options volume. With Grayscale and Bitwise also launching BTC options contracts, this activity is likely to intensify.

The Road to $100K

With Bitcoin’s price hovering around $96-97k, the crypto king seems mere inches away from the six-figure mark. Adding to the hype, a Shanghai court recently clarified that owning crypto is not illegal in China, boosting global confidence.

In the US, Bitcoin ETF assets under management have hit $104 billion, with year-to-date inflows doubling initial projections. Senator Cynthia Lummis continues advocating for Bitcoin, even proposing a national strategic reserve. Her latest tweet hints at Bitcoin as a solution to the national debt.

However, large Bitcoin holders appear to be selling aggressively even as retail buyers snap up BTC. This tug-of-war could spark near-term volatility. While the bullish narrative remains strong, the path to $100k may not be smooth.

What’s Next for Altcoins?

If Bitcoin corrects sharply after crossing $100k, altcoins could face an even bigger drop due to higher volatility. However, such declines often precede an explosive altcoin rally.

In 2021, after Bitcoin peaked, its dominance declined and Ethereum and smaller altcoins went on a tear. A similar rotation from Bitcoin gains into altcoins could occur again. But with Bitcoin’s dominance still elevated, the spotlight remains locked on BTC for now.

Conclusion

While $100k Bitcoin seems imminent, crypto markets could see dramatic swings at any moment. But the larger adoption trend persists, so any dips likely to be temporary. For altcoins, Bitcoin’s next move could determine whether they flourish or flounder. Buckle up for an exciting ride ahead!