- Solana-based apps recorded significant fees and revenue growth in 24 hours during a memecoin trading boom.

- Raydium, a Solana-based AMM, achieved $11.31M in fees, its highest daily figure to date.

- Native Solana token SOL surged to $242, its peak since November 2021, fueling ecosystem activity.

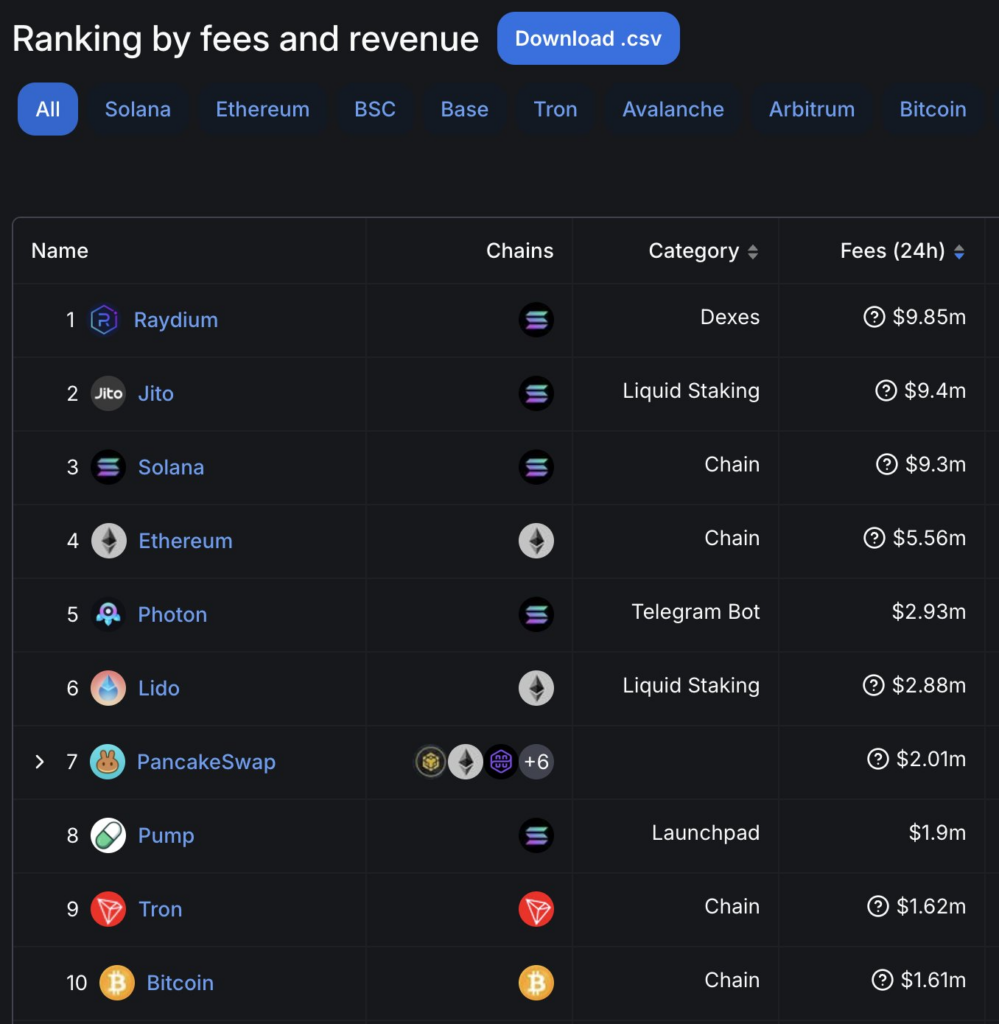

In the past 24 hours, Solana-based decentralized applications reported record-breaking fees, indicating a sharp rise in activity driven by renewed interest in memecoins. This surge also coincided with a significant price spike for Solana’s native cryptocurrency, SOL, reaching $242—its highest value in three years.

Among the most notable performers, decentralized exchange Raydium generated $11.31 million in fees on November 17, marking its most profitable day. Jito, a liquid staking platform, also posted impressive figures with $9.87 million, its third-largest fee collection day to date. These statistics were shared by DeFi analyst Patrick Scott using data from blockchain tracker DefiLlama.

Major Players in Solana’s Fee Boom

Another standout performer was pump.fun, a memecoin launchpad that reported its seventh-highest fee collection at $1.65 million. Photon, a Telegram-based trading bot for Solana memecoins, saw $2.36 million in fees, ranking among its top five revenue days.

The fee records for Solana protocols occurred during a period of heightened memecoin speculation. This excitement within the ecosystem has also pushed SOL prices upward, solidifying its recovery trajectory since November 2021.

Source: Dynamo Patrick

Broader Implications for the Solana Ecosystem

The revenue uptick across multiple Solana protocols suggests growing enthusiasm for blockchain-powered trading platforms. The ecosystem’s performance, coupled with the rising SOL value, highlights its resilience and ability to capitalize on trends like memecoin trading surges. Observers note that Solana continues to gain momentum as blockchain adoption grows, benefiting from both technical capabilities and market opportunities.