- Bitcoin briefly hit a record high of $90,000, then dropped to $85,000.

- Derivatives market faced nearly $1 billion in liquidations as volatility hit both longs and shorts.

- Dogecoin recorded higher liquidations than Ethereum, driven by a 21% price surge.

Bitcoin has experienced a turbulent 24 hours, briefly reaching an all-time high near $90,000 before falling back to $85,000. The leading cryptocurrency quickly rebounded, reaching $88,500 by the end of the day. Bitcoin’s rapid price movements had a ripple effect on other digital assets, which followed a similar volatile path.

$1 Billion in Liquidations Hits Crypto Derivatives Market

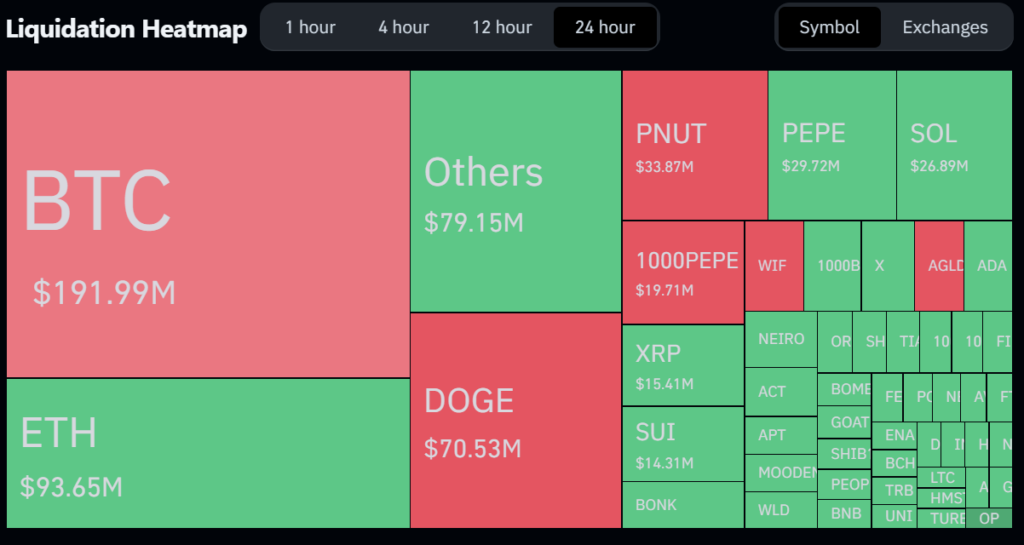

The sudden swings in Bitcoin’s price created significant activity on the derivatives market, resulting in approximately $973 million in liquidations. Data from CoinGlass shows that of these liquidations, $580 million involved long positions, while $393 million were shorts. Bitcoin alone contributed over $270 million to the liquidated positions.

This sharp liquidation of longs suggests that many traders entered bullish positions only after Bitcoin had already climbed, catching them off guard when the asset retraced. Shorts also felt the pressure, as volatility impacted positions in both directions.

Source: CoinGlass

Dogecoin Outpaces Ethereum in Liquidations

Interestingly, Dogecoin saw higher liquidations than Ethereum, despite the latter’s larger market cap. DOGE’s recent 21% price increase has led to heightened trading activity, which contributed to this unusual liquidation pattern. The intense price action highlights the current state of unpredictability in the crypto market as it responds to rapid fluctuations.