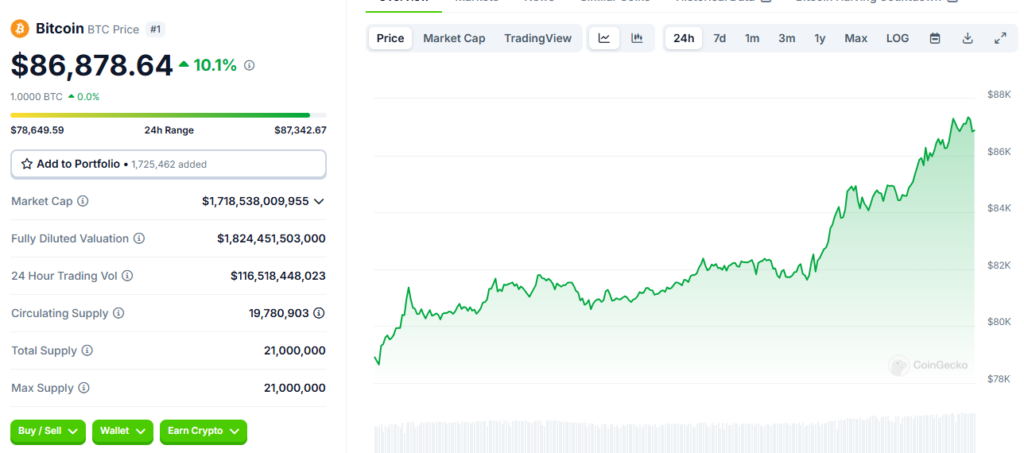

- • Google searches for Bitcoin surged as the cryptocurrency’s price hit a new all-time high above $80,000.

- • The surge in interest reflects growing global attention as Bitcoin continues to gain traction among retail and institutional investors.

- • Donald Trump’s victory in the US presidential election and his proposed pro-crypto policies, including plans for a national Bitcoin reserve, contributed to the spike in Bitcoin interest.

Google searches for Bitcoin have surged as the cryptocurrency’s price continues to reach new all-time highs above $80,000. This growing interest reflects Bitcoin’s increasing mainstream adoption among both retail and institutional investors.

Trump’s Election Provided Initial Spark

Cryptocurrency interest soared after Donald Trump‘s victory in the 2024 US presidential election. His campaign pledged support for the crypto sector, outlining plans for a national Bitcoin reserve and ending the “war” on crypto regulation. While the proposed reserve would likely take time to materialize, the community sees a clear path for Bitcoin to become a treasury asset. As such, experts point to the spike in searches and inflows as signs of fresh retail interest.

Market Euphoria But Cautious Optimism

Bitcoin’s rise is unfolding with minimal volatility as heavy options selling has dampened any major price swings. This suggests the market was prepared for the bullish momentum. However, trading firms remain cautiously optimistic, noting the risk of short-term pullbacks and volatility easing as markets await key macro events this week.

Bitcoin Consolidating Before Next Move

Perpetual funding rates and basis yields have reached peaks not seen in months, indicating strong bullish sentiment. However, these sharp increases are often short-lived. For now, experts expect Bitcoin prices to consolidate around current levels before making its next major move.

Macro Events Could Impact Bitcoin’s Trajectory

Key data releases this week, including CPI, PPI, and a speech by Fed Chair Jerome Powell, could provide insight into the likelihood of a December rate cut. These macro factors could influence Bitcoin’s trajectory in the near-term.

Conclusion

With Bitcoin establishing new highs, interest and adoption continue growing. But the market remains cautiously optimistic amid risks of volatility and potential pullbacks ahead of major economic data releases. Expect prices to consolidate at current levels before Bitcoin’s next major breakthrough.