- High-risk DeFi loans hit a two-year peak, reaching over $5 million, signaling rising market exposure.

- DeFi’s maturation and risk management practices may cushion the impact of large-scale liquidations.

- Increased DeFi lending activity reflects post-election investor confidence but highlights potential risks in volatile assets.

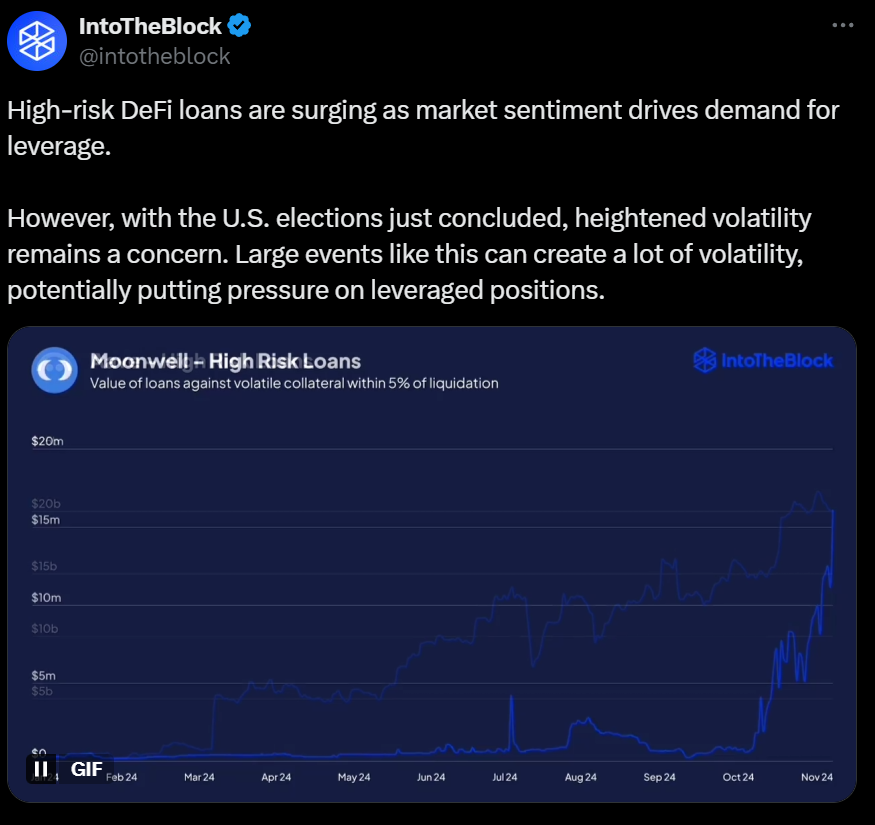

The value of high-risk decentralized finance (DeFi) loans has climbed significantly, reaching levels not seen in more than two years, driven by post-election investor enthusiasm. According to data from IntoTheBlock, the volume of these high-risk loans—collateralized by volatile assets close to their liquidation thresholds—rose above $5 million on Oct. 16. Such loans, often used by investors to benefit from asset price swings, now present heightened exposure to market volatility.

Alexander Sudeykin, co-founder of Evaa Protocol on The Open Network (TON), noted that while extensive liquidations could impact the broader cryptocurrency market, the effects may be limited due to the maturing DeFi industry. Sudeykin added that many established DeFi platforms have implemented robust risk management strategies to handle potential downturns, offering a layer of stability against market disruptions.

Source: IntoTheBlock on X

DeFi’s Market Evolution and Resilience

The decentralized finance sector, while offering accessible loans beyond traditional banking constraints, bears higher risks due to its reliance on overcollateralized and often volatile assets. The potential for sudden price drops in these assets, as seen in June when Curve Finance founder Michael Egorov faced over $100 million in loan liquidations, underscores the challenges in managing large-scale DeFi positions. Egorov’s case highlighted how asset volatility, such as a 28% drop in Curve’s CRV token, can lead to cascading liquidations in highly leveraged positions.

Despite this risk, Sudeykin and other industry commentators believe that DeFi’s continued evolution, marked by asset caps, isolated liquidity pools, and enhanced protocols, has improved its resilience. Such measures help reduce the likelihood of widespread liquidations impacting the broader market.

Market Sentiment and Investor Confidence

Analysts view the recent spike in DeFi loans as part of broader optimism following the U.S. election, with investors looking to capitalize on the favorable market conditions. However, the elevated level of high-risk loans may still prompt caution among market participants as DeFi’s exposure to asset price fluctuations could affect the crypto sector if loan liquidations accelerate.