- Bitcoin whales acquired $142 million in BTC after Trump’s re-election, pushing prices higher

- Trump’s win raises projections for Bitcoin, with some analysts eyeing a rally past $100,000

- Republican-led Congress may create a more favorable regulatory climate for cryptocurrency

Following Donald Trump’s re-election on November 6, two major Bitcoin holders, or “whales,” significantly increased their BTC holdings. This activity reflects rising interest in risk assets, particularly Bitcoin, which hit a new high of $76,400 shortly after the election results.

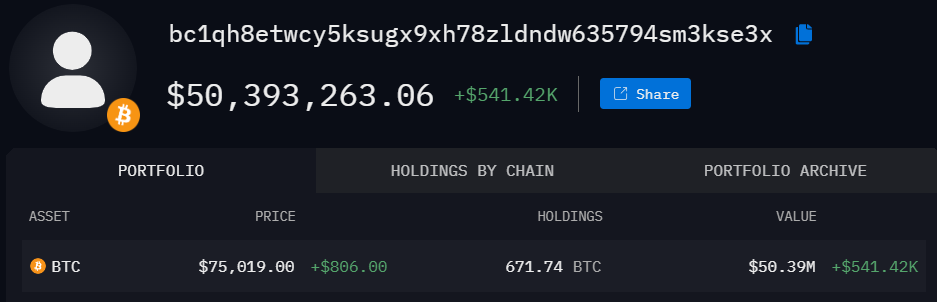

Data from Arkham Intelligence shows that on November 7, an unidentified whale wallet known as “bc1qh” acquired over $50.4 million in Bitcoin from Binance. Another whale address, “bc1qa,” purchased more than $92 million worth of Bitcoin on the same day, having started its accumulation just before the election. Together, the two wallets acquired $142 million in Bitcoin since Trump’s win, a signal of increasing investor interest.

Source: Arkham Intelligence

Whales and Market Sentiment

Whales, with their large holdings, can heavily influence the crypto market, and their buying patterns often attract attention from other investors. Analysts see the recent whale activity as a bullish signal, with projections suggesting Bitcoin could rise to $100,000 by year’s end. Bitget Research’s chief analyst, Ryan Lee, believes that Bitcoin’s market could see strong leverage, particularly as stablecoin market caps reach record levels.

This sentiment was echoed in the options market, where end-of-year call options for Bitcoin at a strike price of $80,000 have seen heightened interest. Analysts from Bitfinex suggest that options positioning may push Bitcoin toward $80,000 before the close of 2024, supported by favorable market structures and Republican-led government policies.

Pro-Crypto Regulatory Outlook

Trump’s victory could usher in a regulatory environment more supportive of cryptocurrency. With a Republican majority in the Senate, there is potential for less restrictive policies, as highlighted by Coinbase CEO Brian Armstrong. Andrey Lazutkin, CTO of Tangem Wallet, stated that Republicans’ preference for fewer regulations may foster an innovation-friendly climate, benefiting U.S.-based crypto businesses.

As new whale addresses emerge and regulatory optimism grows, the crypto community anticipates a potentially favorable market and policy environment that could drive further gains for Bitcoin and other digital assets in the coming months.