- Bitcoin price target is $120K, according to an analyst, as the MVRV ratio has flipped bullish

- The MVRV ratio surpassing the 365-day average suggests the uptrend remains intact, with cycle peak potentially occurring when MVRV reaches 3 to 3.6

- Bitcoin is trading above the 20-day EMA around $68,000, which serves as a strong support level

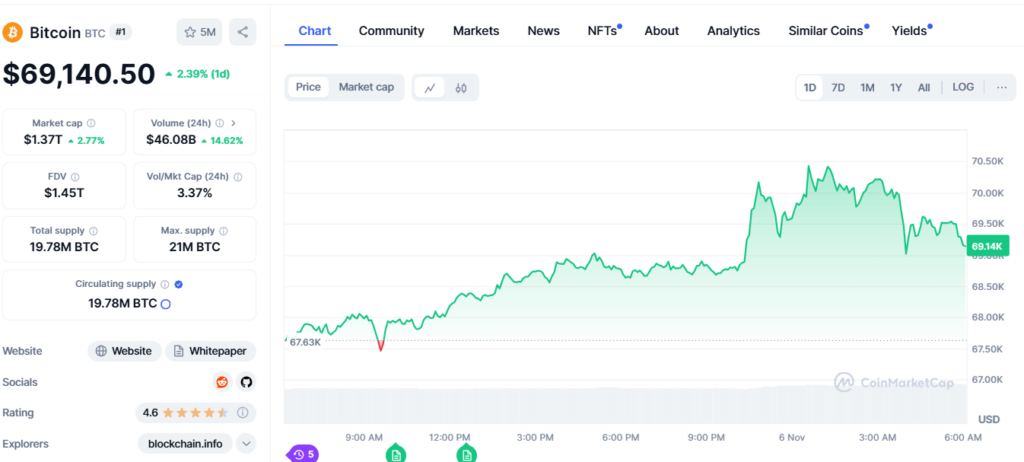

Bitcoin’s price has risen back above $69,000, nearing its all-time high from 2022. According to analysts, an important on-chain metric known as the market value to realized value (MVRV) ratio has recently flipped bullish. This suggests Bitcoin’s uptrend toward $120,000 remains intact.

MVRV Ratio Points to $120K Bitcoin Price Target

The MVRV ratio compares Bitcoin’s current market valuation to its realized value, which is calculated based on the price when each coin last moved on-chain. The ratio recently rose above both its 365-day average and 4-year average.

Historically, Bitcoin tops out when the MVRV reaches between 3 and 3.5. Assuming Bitcoin’s realized value stays constant, the ratio suggests Bitcoin’s price could rise to between $95,000 and $120,000 to reach these levels again. With Bitcoin already up significantly over the past year, the upward momentum seems likely to continue.

Bitcoin Trades Above Key Support Around $68,000

In addition to the bullish MVRV signal, Bitcoin is trading above the crucial support level of its 20-day exponential moving average, currently around $68,200. This EMA level coincides with a price range where around 11 million BTC was previously purchased by over 25 million addresses.

According to analysis from IntoTheBlock, Bitcoin currently faces much weaker resistance above compared to the strong support below $68,000. This suggests the path of least resistance is for Bitcoin to move higher from current levels.

Conclusion

While macroeconomic issues have recently whipsawed crypto markets, Bitcoin’s bullish technicals support the case for continued upside. The MVRV ratio flipping positive after remaining below its multi-year average, along with Bitcoin holding key support around $68,000, point toward price targets of $95,000 to $120,000.