- Bitcoin prices are close to record highs, yet retail investor activity remains muted

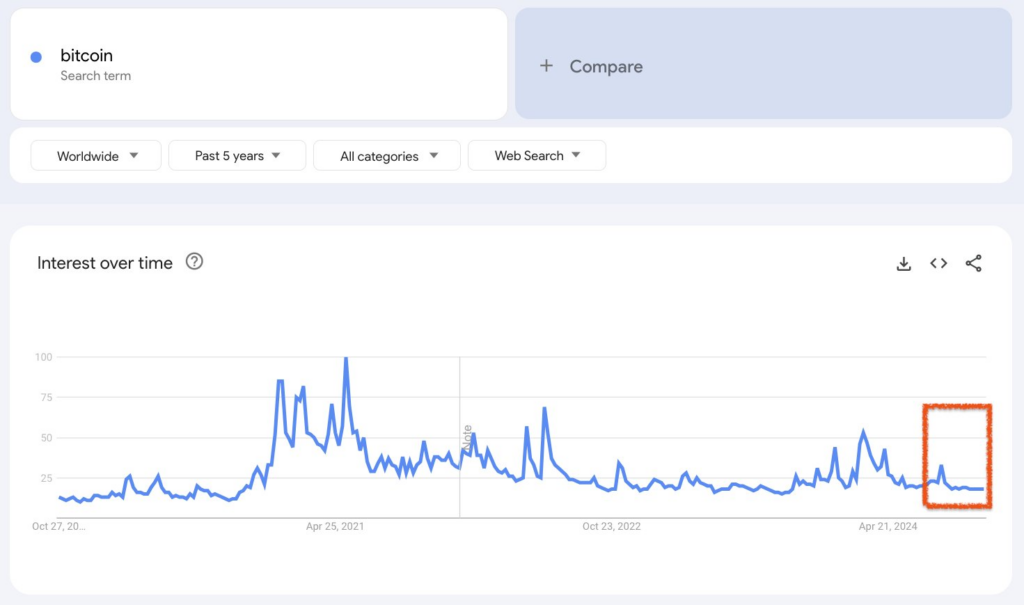

- Search interest for “Bitcoin” is low, contrasting previous spikes during market rallies

- Institutional demand for Bitcoin grows significantly, spurred by ETF investments since January

Bitcoin’s approach to record prices has stirred speculation among analysts, though retail investor engagement remains subdued. Recent data reveals that despite Bitcoin’s October 29 high of $73,562—just shy of its all-time peak—search trends and app rankings indicate a lack of widespread retail interest in the cryptocurrency.

Crypto analyst Miles Deutscher pointed out that retail investors have shown little additional interest, even as Bitcoin’s price has surged. Google Trends data supports this, with search interest for “Bitcoin” scoring just 23 out of 100 relative to its peak in May 2021. Comparatively, “artificial intelligence” continues to attract significantly more attention.

Source: Miles Deutscher on X

App Rankings Reflect Retail Interest Levels

Historically, during Bitcoin bull markets, apps like Coinbase saw increased popularity on platforms like Apple’s App Store. Coinbase currently ranks 308th, though it recently climbed over 160 spots on October 28 and 29, suggesting a slight uptick in retail interest as Bitcoin prices rise. However, a report from CryptoQuant underscores that larger Bitcoin investors, rather than smaller retail participants, have primarily driven market activity this year.

Institutional Interest Outpaces Retail Growth

While retail involvement remains modest, institutional demand for Bitcoin has seen a sharp increase. According to Farside, spot Bitcoin exchange-traded funds (ETFs) in the United States, launched earlier in the year, have significantly influenced institutional holdings, with net inflows surpassing $22.7 billion. CryptoQuant’s CEO Ki Young Ju noted that institutional demand in custodial wallets has doubled retail levels over the past 12 months.

CryptoQuant’s data suggests that low retail participation has often preceded Bitcoin price rallies in previous cycles, raising the possibility that a surge in retail engagement could follow if Bitcoin’s price momentum continues.