- Ripple has filed an appeal challenging the SEC’s ruling on institutional XRP sales as securities.

- Ripple contests the district court’s use of the Howey test in its securities classification.

- The SEC’s October appeal does not challenge the decision that XRP is not a security in digital asset exchanges.

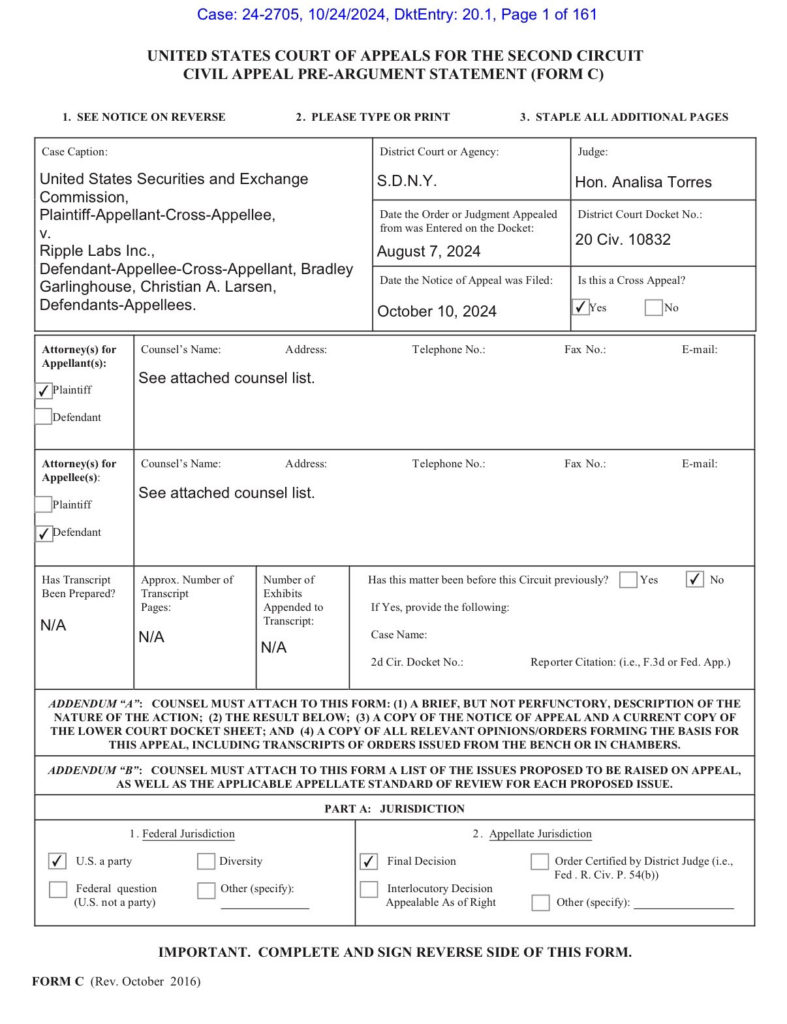

Ripple Labs has filed an appeal in the U.S. Court of Appeals for the Second Circuit, challenging a ruling by the U.S. Securities and Exchange Commission (SEC) that classified institutional sales of its cryptocurrency XRP as securities transactions. The filing, announced by Ripple’s Chief Legal Officer Stuart Alderoty on October 25, follows a district court ruling in August imposing a $125 million fine on Ripple for its institutional XRP sales.

Source: Filan Law

Dispute Over Securities Classification

Ripple’s appeal focuses on the district court’s interpretation of the Howey test, which determines whether a transaction qualifies as an investment contract. Ripple argues that the court misapplied this test to its institutional XRP sales to accredited investors, challenging the classification as securities transactions. The appeal seeks a “de novo” review, allowing the appellate court to reconsider the legal basis of the initial ruling without deferring to the district court’s conclusions.

Alderoty expressed optimism about the appeal process, adding that the SEC’s strategy of “distraction and confusion” was losing significance in Ripple’s ongoing legal journey.

Background on SEC’s Partial Appeal

Ripple’s appeal follows the SEC’s own appeal on October 16, which questioned the district court’s partial summary judgment favoring Ripple. Notably, the SEC’s appeal did not dispute the decision that XRP is not considered a security in programmatic sales on digital asset exchanges. This distinction remains central to the case, as U.S. District Judge Analisa Torres previously ruled that XRP’s programmatic sales on exchanges did not constitute securities transactions.