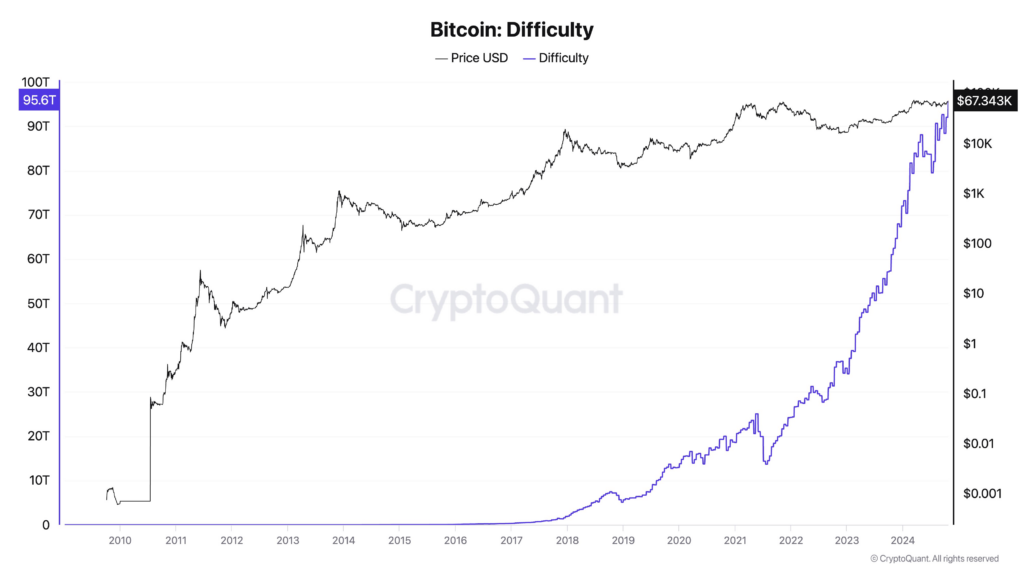

- Bitcoin mining difficulty increased 378% in three years due to institutional investments in large-scale mining operations.

- CryptoQuant’s Ki Young Ju predicts Bitcoin could evolve into a stable currency by 2030.

- Analysts highlight $65,000 as a key support level for maintaining Bitcoin’s current upward trend.

Bitcoin mining difficulty has skyrocketed by 378% over the past three years, largely driven by increasing institutional investment in large-scale mining operations. This surge has led to fierce competition in the mining space, pushing entry barriers higher for individual miners. Despite these challenges, Ki Young Ju, CEO of CryptoQuant, views the rising difficulty as a potential positive for Bitcoin’s long-term stability.

Source: Ki Young Ju on X

Institutional Influence and Bitcoin’s Future Stability

Historically, Bitcoin and the broader cryptocurrency market have been associated with high levels of volatility. However, the growing participation of institutional investors has led to increased mining difficulty and centralization of computing power. Ki Young Ju suggests this could contribute to Bitcoin’s evolution into a more stable currency by 2030. He believes that as institutional dominance continues, volatility in the cryptocurrency market may decrease.

Ju also highlighted that major fintech players are expected to drive mass adoption of stablecoins in the coming years. By the time of Bitcoin’s next halving event in 2028, he predicts that the use of BTC as a currency will become a serious topic of discussion.

Challenges for Bitcoin Layer-2 Solutions and Price Stability

While layer-2 solutions like the Lightning Network have been promoted as key to Bitcoin’s scalability, their adoption has lagged behind that of venture capital-backed blockchains. Ju stressed that institutional support is essential for boosting the adoption of BTC’s layer-2 infrastructure. Wrapped Bitcoin (WBTC) presents a notable competitor, offering a way to integrate Bitcoin into various ecosystems without the need for complex layer-2 infrastructure.

On the price front, Bitcoin recently tested the $69,000 mark for the first time since June. Analysts, including Keith Alan from Material Indicators, are closely watching the $65,000 support level. Alan believes that if Bitcoin can maintain its position above the 21-week moving average, the current bullish trend may continue. Some market observers expect Bitcoin to potentially retest its all-time high before the year ends, though macroeconomic factors and market volatility remain critical to its future performance.