- Bitcoin dipped to $60,063, challenging key support levels amid market consolidation.

- Traders suggest Bitcoin must close above $66,500 by week’s end for trend strength.

- Analysts see potential for upside as Bitcoin remains supported ahead of key economic data.

Bitcoin’s price dropped to a one-week low on October 23, touching $60,063 on Bitstamp. This decline added pressure on bulls as the cryptocurrency continues to consolidate after failing to break through the $69,000 resistance level. The dip, representing a 1.5% decline for the day, sparked concerns among traders about Bitcoin’s short-term trajectory.

Key Weekly Close Will Shape Short-Term Outlook

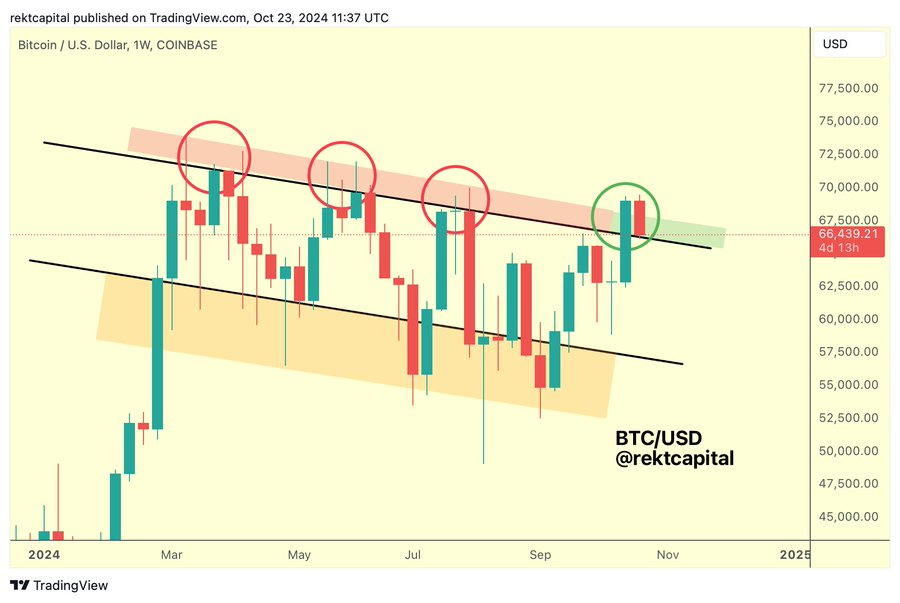

Analyst Rekt Capital pointed out that Bitcoin’s price needs to close above $66,500 by the end of the week to maintain upward momentum. According to him, the price is currently retesting a former resistance level, which is now serving as support. The success of this retest, he noted, is crucial for Bitcoin’s short-term strength.

Source: RektCapital on X

Other analysts, such as CryptoBullet, are more optimistic. Leveraging the MACD (moving average convergence/divergence) indicator, they highlighted that Bitcoin has crossed into bullish territory for the first time since October 2023. This technical pattern, often used to gauge trend strength, suggests a potential move to new all-time highs, similar to the 2021 rally that preceded Bitcoin’s record-breaking $69,000 price.

Macro Factors and Upcoming Events

Despite the price consolidation, both Bitcoin and Ether remain well-supported, with analysts forecasting potential upside. The upcoming U.S. presidential election and the Federal Reserve’s meeting on interest rates in early November are likely to serve as key market catalysts. Trading firm QCP Capital emphasized that the nonfarm payrolls report, due on November 1, will be closely watched, as it could shape market expectations ahead of the Fed’s next move on interest rates.