The U.S. Securities and Exchange Commission (SEC) and Ripple Labs have filed motions for summary judgment, asserting that there is enough evidence for the presiding judge to make a ruling without the case going to trial.

The SEC and Ripple Labs want the Southern District of New York Judge Analisa Torres to judge whether the San Francisco-based crypto company- the company behind XRP – violated federal securities laws based on the arguments in the accompanying documents.

Calls For Rapid Ruling On Ripple vs. SEC Case

In December 2020, the SEC sued Ripple Labs, CEO Brad Garlinghouse, and Chairman Chris Larsen (both Ripple co-founders), alleging that they raised over $1.3 billion by selling XRP coins as unregistered securities. Ripple denied that XRP coins were not sold in securities transactions as the sales and trading did not meet the threshold of the Supreme Court’s Howey test, which has been used to determine whether something is a security for the last several decades.

According to the initial filing by the SEC, Ripple Labs started selling XRP crypto as an unregistered security offering to U.S. and foreign investors in 2013 to make profits. The regulator also claimed that the blockchain company gave out billions of XRP coins in return for non-cash benefits such as labor and market-making services. In his 2018 speech, Bill Hinman (a former SEC employee) explained that he did not consider competing for digital assets like Bitcoin (BTC) and Ether (ETH) as they were not securities.

This speech has sparked debate around the XRP vs. SEC lawsuit. Despite attempts by the SEC to protect papers and communications related to the address, Ripple has managed to gain access to them and presented them in court.

Over the past two years, the parties have filed various discovery motions without tackling whether Ripple violated the securities law by selling XRP.

The motions for summary judgment filed in the U.S. District Court

On Friday, the Southern District of New York means that the parties are asking the judge to decide whether Ripple Labs or the SEC has provided enough evidence to prove whether or not there was a violation. They asked District Judge Analisa Torres to choose based on the arguments presented in the supporting papers and statements.

The courts make summary judgments when the parties believe the statement and evidence are enough to make a ruling without the need to go to trial.

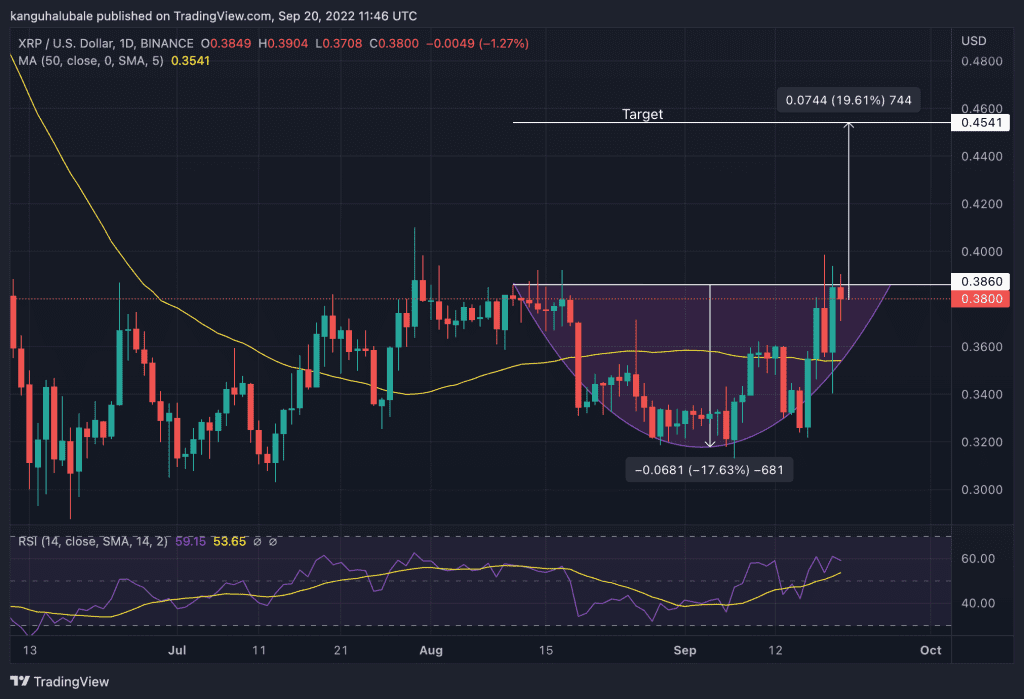

XRP Price Action

The current XRP price is $0.38, and the 24-hour trading volume is $2.49 billion. In the last 24 hours, XRP has climbed 8.41%. Today, the XRP price achieved a high of $0.3904 and a low of $0,3708 after opening at $0.3849. The ongoing legal fight between the SEC and Ripple has kept the XRP price from breaking into a full-blown recovery.

But the case’s progression to the Summary Judgment stage has seen increased positive sentiment toward XRP. The price action had formed a rounded bottom technical pattern on the daily chart. As such, increased buying pressure from the current price could see the cross-border payments token climb to the target of the prevailing chart pattern at $0.4541. This would represent a $19.61 ascent from the current price.

Apart from the significantly bullish chart pattern, the relative strength index (RSI) position at 59 suggested that the buyers had returned to the scene. This and the likelihood of a favorable verdict in the Ripple lawsuit will continue fueling an increase in XRP price.

On the downside, the price may turn down from the current levels to seek solace from the $0.36b psychological level. Lower than that, XRP may fall first toward the 50-day simple moving average (SMA) at $0.3541 and later to the bottom of the chart pattern at $0.3180. XRP could accumulate here before initiating a recovery.