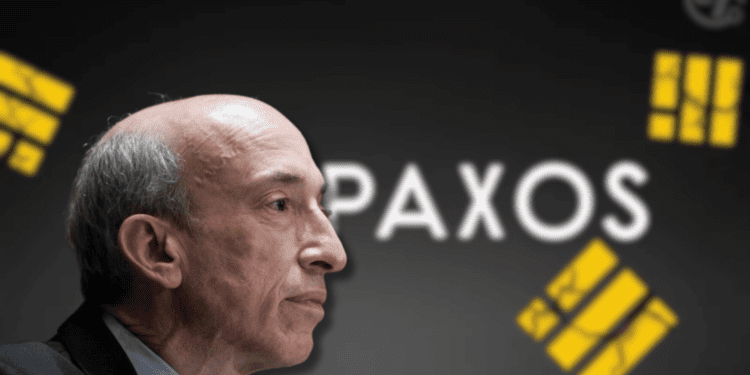

• SEC ends investigation into stablecoin issuer Paxos, declares BUSD not a security

• Paxos received Wells Notice from SEC a year ago signaling enforcement action over BUSD stablecoin

• Recent court ruling that BUSD sales did not constitute securities offering may have influenced SEC’s decision

The SEC has ended its investigation into stablecoin issuer Paxos and its partnered BUSD token with Binance. This is a major win for the crypto industry, as BUSD has been declared not a security.

Background on the SEC Investigation

In July 2022, Paxos received a Wells Notice from the SEC, signaling potential enforcement action related to BUSD. The investigation went on for over a year, creating uncertainty around one of the largest stablecoins.

The SEC Shifts Stance on Crypto

This conclusion to the Paxos case aligns with recent comments from CFTC Chair Rostin Behnam, who said 70-80% of cryptocurrencies are not securities. It caps off a series of pro-crypto moves by regulators.

A Crucial Distinction for Stablecoins

By deeming BUSD not a security, the SEC draws an important distinction in the stablecoin market between regulated securities and unregulated commodities. This precedent could enable further mainstream adoption.

Looking Ahead with More Regulatory Clarity

Ending the probe into Paxos and BUSD should hopefully provide more certainty for crypto businesses in the US. Major traditional finance firms like PayPal and VanEck have started issuing stablecoins, and clear rules will help the industry thrive.