- MicroStrategy has increased its convertible senior notes offering from $500 million to $700 million to fund additional Bitcoin purchases and general corporate purposes.

- The notes will bear an interest rate of 2.25% per annum, payable semi-annually, and mature on June 15, 2032, unless earlier repurchased, redeemed, or converted.

- MicroStrategy estimates net proceeds from the sale to be approximately $687.8 million, which it intends to use to acquire more Bitcoin and for general corporate purposes.

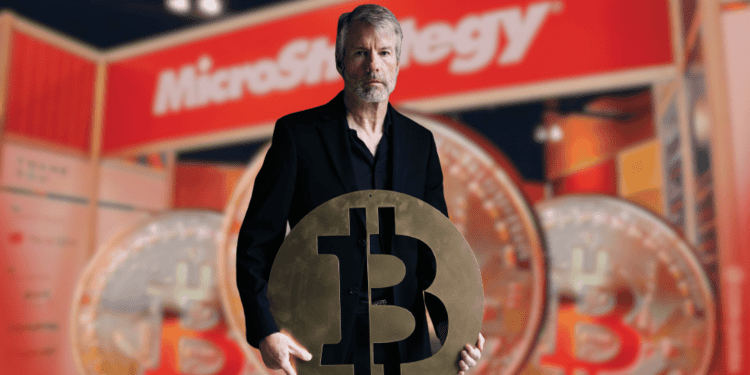

American software technology firm MicroStrategy has announced plans to raise $700 million through a new debt offering in order to purchase additional Bitcoin for its corporate treasury. This comes just a day after the company revealed a smaller $500 million offering for the same purpose. Let’s take a look at the details of MicroStrategy’s latest stock sale and how the company plans to use the proceeds.

Offering Terms and Conditions

The $700 million of senior unsecured notes will mature in 2032 and pay 2.25% interest semi-annually. The notes will be sold in a private offering to qualified buyers. MicroStrategy has the option to redeem the notes for cash after June 20, 2029.

Use of Proceeds

MicroStrategy expects net proceeds of approximately $688 million after fees and expenses. The company plans to use the funds primarily to continue expanding its Bitcoin holdings. MicroStrategy currently owns about 129,699 BTC worth over $3 billion.

Acquiring More Bitcoin

By upsizing this debt offering, MicroStrategy is aggressively pursuing its strategy of making Bitcoin its primary corporate treasury asset. The company views Bitcoin as a long-term store of value and aims to take advantage of market dips to accumulate more.

Private Placement

It’s important to note the notes are being sold privately under SEC Rule 144A. This means they cannot be traded on public markets unless they are registered with the SEC. The private placement allows MicroStrategy to raise funds more quickly.

Conclusion

MicroStrategy’s $700 million debt issue highlights the company’s laser focus on expanding its Bitcoin trove. Despite risks and volatility, MicroStrategy remains committed to making Bitcoin its primary corporate reserve asset. It will be interesting to watch how much BTC the firm is able to snap up with its latest capital raise.