- Nvidia is reporting its fiscal first-quarter 2025 earnings after the bell on Wednesday, with Wall Street expecting revenue growth in excess of 200% for the third straight quarter.

- Nvidia’s AI chips have been in high demand from major tech companies like Google, Microsoft, Meta, and Amazon, driving its meteoric growth over the past year.

- There are questions about the sustainability of Nvidia’s growth as customers may be eyeing the company’s next-generation AI chips, and the company will face tough year-over-year comparisons starting in the fiscal second quarter.

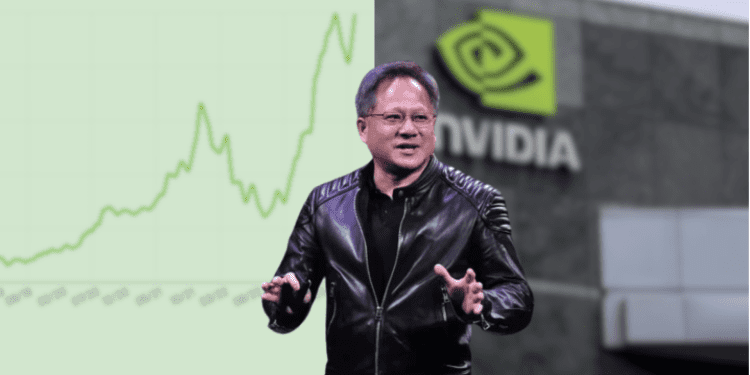

Nvidia is set to report its fiscal first quarter 2025 earnings after the bell on Wednesday. The company has seen tremendous growth over the past year, driven by demand for its graphics processing units (GPUs) to power artificial intelligence.

Nvidia’s Transformation into an AI Powerhouse

Just a decade ago, Nvidia was known primarily as a niche developer of 3D gaming hardware. But the company’s GPUs turned out to be perfectly suited to accelerate AI workloads. Now Nvidia finds itself at the heart of the AI boom, with its chips becoming indispensable to companies like Google, Microsoft, Meta, Amazon and OpenAI.

First Quarter Expectations

Wall Street expects Nvidia’s momentum to continue in Q1. Analysts forecast:

- Earnings per share: $5.59 adjusted

- Revenue: $24.65 billion

This would represent revenue growth of over 200% for the third quarter in a row. Net income is expected to surge more than fivefold.

Driving Demand: The Need for AI Infrastructure

Nvidia’s current generation of GPUs for AI, called Hopper, have become a must-have for top AI researchers. Customers are snapping them up to build out infrastructure for chatbots, translations, image generation and more AI applications.

Cloud and internet giants are spending billions on Hopper GPUs. Nvidia’s data center revenue hit a record $3.26 billion last quarter.

Questions Around the AI Investment Cycle

But questions linger about the sustainability of Nvidia’s steep growth trajectory. At some point, companies will need to demonstrate profitability from their big AI investments.

And Nvidia is starting to ship next-gen GPUs, code-named Blackwell, which could cause a pause in sales of Hopper chips.

Nvidia’s Outlook

Starting next quarter, Nvidia’s comps get much tougher. Analysts expect growth to dip below 100% in Q2 as the company laps its initial surge in AI demand.

Investors will be listening closely to management’s guidance on Wednesday for signs of an AI spending slowdown.

Conclusion

Nvidia’s first quarter earnings will provide critical insight into the health of the AI investment cycle. All eyes are on the chipmaker to see if it can sustain its incredible run.