- FBI and New York authorities have arrested Idin Dalpour for orchestrating a $43 million Ponzi scheme.

- Dalpour falsely promised investors high returns from ventures in Las Vegas hospitality and cryptocurrency trading.

- The scheme involved fake contracts and bank statements, and misused investor funds for personal expenses.

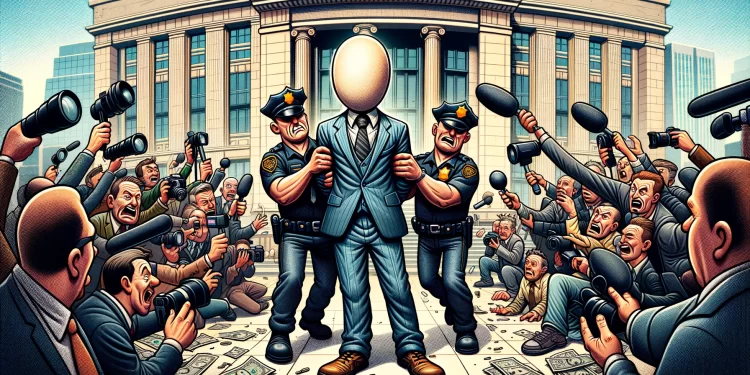

Authorities in New York have apprehended Idin Dalpour on charges of running a sophisticated $43 million Ponzi scheme. The scheme involved deceitful investment opportunities in a Las Vegas hospitality venture and a cryptocurrency trading operation.

Details of the Scheme

United States Attorney Damian Williams and FBI Assistant Director James Smith announced the charges, detailing how Dalpour enticed investors with the allure of high returns—starting at an annual rate of 42%. He misled investors about the safety of their investments through supposedly secured insurance and escrow services.

Dalpour, controlling a specific entity, misrepresented its engagements in both the hospitality and cryptocurrency sectors. He claimed to buy cryptocurrency at wholesale prices and sell it at a profit to retail investors. This facade was supported by falsified contracts, bank statements, and emails designed to convince investors of the ventures’ legitimacy.

Misuse of Funds and Legal Repercussions

The indictment reveals that the collected investment funds were not used as promised. Instead, Dalpour diverted these funds to pay returns to earlier investors, cover his personal expenses including gambling losses, and pay for his children’s private school tuition.

The fraud was uncovered when a group of victims confronted Dalpour in November 2023, leading to his confession and arrest. This case underscores ongoing concerns over fraudulent schemes within the cryptocurrency space, as highlighted by recent similar incidents investigated by U.S. officials.

Continued Vigilance Against Financial Fraud

Assistant Director James Smith of the FBI emphasized the importance of the arrest, noting it as a testament to the FBI’s commitment to maintaining economic justice. This arrest is part of a broader effort by U.S. law enforcement to tackle Ponzi schemes and other fraudulent activities, particularly those involving cryptocurrencies.