- Sam Bankman-Fried is sentenced to 25 years for his role in the collapse of cryptocurrency exchange FTX.

- The court rejects Bankman-Fried’s claim of no financial loss at FTX, identifying over $550 million in fraud.

- Victims express the severe impact of Bankman-Fried’s fraud during the court proceedings.

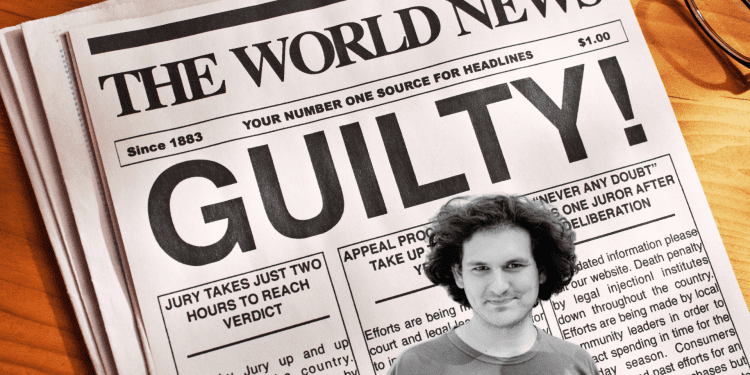

Sam Bankman-Fried, once at the helm of the cryptocurrency exchange FTX, was sentenced to 25 years in prison, a verdict delivered in a Manhattan court. The punishment reflects the gravity of the financial disaster he precipitated, falling between the leniency his defense sought and the harsher penalty prosecutors had advocated for.

According to a report from CNBC, Bankman-Fried expressed deep regret, especially for undermining the efforts of his FTX team. He admitted to the court, including Judge Lewis Kaplan, that his decisions led to unnecessary suffering for customers, emphasizing his ultimate accountability for the company’s downfall. These sentiments reveal a man grappling with the consequences of his actions, particularly the impact on those who trusted and supported him.

The Court’s Stance and Victim Impact

In his ruling, Judge Kaplan dismissed Bankman-Fried’s attempts to downplay the financial havoc wreaked by FTX’s collapse, highlighting the staggering loss amounting to more than half a billion dollars. The judge’s findings extended to Bankman-Fried’s conduct during the trial, noting his dishonesty and attempts to impede justice, factors that could have significantly extended his sentence.

The courtroom became a venue for victims to articulate the profound effects of Bankman-Fried’s deception, sharing their stories of financial and emotional distress. Bankman-Fried faced these individuals, perhaps fully realizing the extent of the harm his actions had caused.

Family Presence and Lasting Lessons

As the proceedings unfolded, the presence of Bankman-Fried’s parents added a personal dimension to the saga. Their son’s conviction on multiple charges not only concludes a chapter in the cryptocurrency narrative but also serves as a cautionary tale for the industry at large.

This case, marked by Bankman-Fried’s acknowledgment of his failings and the court’s rejection of his justifications, underscores the need for integrity and accountability in the burgeoning field of digital finance. The impact of the FTX scandal resonates beyond the courtroom, serving as a reminder of the real-world consequences of virtual financial mismanagement.