- Powell pushed back against market expectations for aggressive rate cuts, saying it’s premature to conclude policy is at an appropriately restrictive level

- Markets reacted positively to Powell’s remarks, interpreting them as slightly dovish though not decidedly so

- Powell acknowledged progress on inflation but said more is needed, reiterating the Fed’s commitment to keeping policy restrictive until inflation clearly heads to 2%

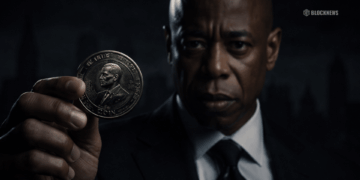

Federal Reserve Chairman Jerome Powell recently commented on market expectations for interest rate cuts, calling them premature. His remarks provided insight into the Fed’s current thinking on monetary policy and the future path of rates.

Powell Says It’s Too Early to Ease Policy

In a speech at Spelman College, Powell pushed back against aggressive market expectations for rate cuts going forward. He stated it would be premature to conclude that policy is at an appropriately restrictive level or to speculate on potential easing. The Fed is prepared to continue tightening if necessary.

Markets View Comments as Dovish Overall

Markets reacted positively to Powell‘s remarks, with stocks moving higher and Treasury yields declining sharply. Investors interpreted the comments as slightly dovish, though not decidedly so. Powell gave some credence to the idea that rate hikes may be paused for now.

The Effects of Tightening So Far

Powell noted that with the series of hikes this year, policy is now well into restrictive territory. He said the full effects likely haven’t been fully felt yet. Tightening is putting downward pressure on economic activity and inflation.

Progress on Inflation But More Needed

On inflation, Powell acknowledged welcome progress in recent months but said more is needed to reach the 2% target. He reiterated the Fed’s commitment to keeping policy restrictive until inflation is clearly heading back to 2%.

Data Dependence Guides Future Decisions

Powell stated the Fed is making decisions meeting by meeting based on incoming data and its implications. He said the FOMC will let the data determine if policy is restrictive enough or needs further tightening.

Conclusion

Powell’s remarks affirmed the Fed’s data-dependent approach while pushing back on expectations for near-term rate cuts. The Fed appears set to maintain its current restrictive stance for now as it assesses progress on inflation.