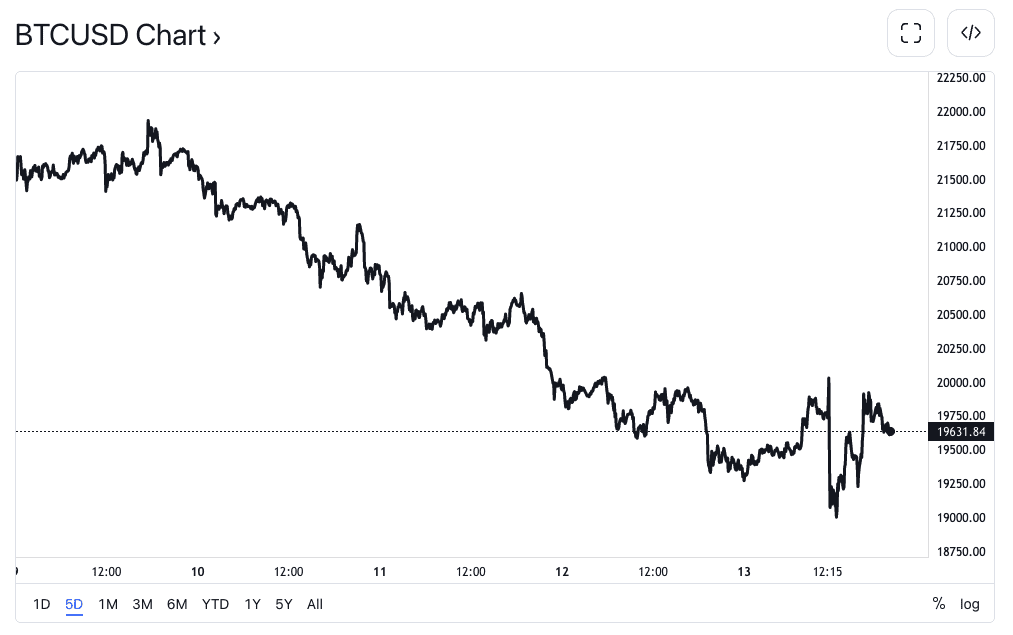

Bitcoin (BTC) dropped for the fifth day in a row, trading at around $19,700, down 4.3% over the past 24 hours. Recent dips below $20,000 by bitcoin are interpreted as evidence that the price level is no longer crucial support but rather a signal for a bearish flag. According to analysts, a move below $18,500 would trigger a further collapse. The Fear and Greed Index for cryptocurrencies also showed a low 16 points, marking extreme fear.

Low Confidence of Long-Term Holders

The current market imbalance is particularly worrying, especially given how one-sided the cryptocurrency options trades have become. As of this writing, Bitcoin and the rest of the altcoin market have continued to lower since Friday, July 8.

Looking at the various charts on the 1-Day timeframe on BTC, the consecutive red candles continue to form a bear flag. The price begins to move down the flagpole before immediately bouncing back up as the flag.

Based on prior technical analyses, a commodity’s price usually drops approximately the length of the pole following a flag breakup. As a result, the bear flag is considered a bearish continuation pattern.

The flag in BTC is the corrective rebound from the June 18 low of $17,601 to Friday’s high of $22,400, also known as the flag. The trend line connecting June 18 and July 3 lows and June 26 and July 8 highs depict a flag.

What to Do During a Bear Market

The best thing to do during a bear market is to stay patient and stay the course. Do not FOMO into any trades, and always remember to use stop losses.

When a market is in a downtrend, it can be tempting to short-sell or buy put options to make money off the falling prices. However, this is a risky strategy that can backfire if the market turns around and starts to trend upwards again.

The most optimal way to deal with the bear market is to commit to dollar-cost averaging rather than waiting for a market reversal or timing a green day.