- The SEC has charged Richard Heart, founder of Hex, and three related entities for allegedly conducting unregistered securities offerings worth over $1 billion.

- Heart is accused of marketing Hex as a high-yield ‘blockchain certificate of deposit,’ which allegedly failed to pass the Howey test.

- The SEC’s lawsuit seeks a jury trial, and a permanent ban on Heart and his projects from selling crypto securities.

The United States Securities and Exchange Commission (SEC) has charged Richard Heart, founder of the crypto project Hex, and three associated entities with allegedly conducting unregistered securities offerings worth more than $1 billion. This case underscores the ongoing challenges and regulatory concerns surrounding cryptocurrencies, highlighting the SEC’s commitment to protecting investors from potentially fraudulent operations.

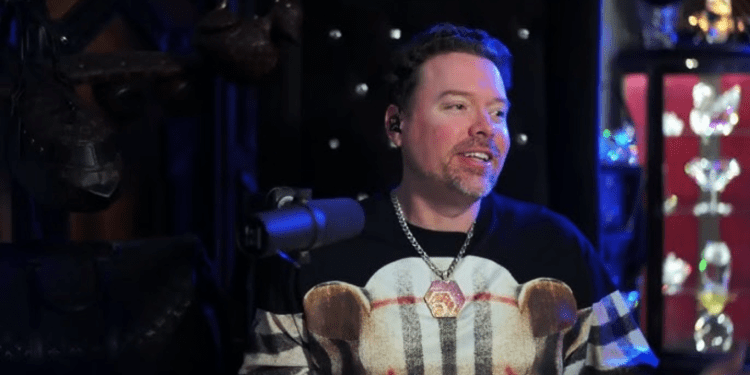

Richard Heart, real name Richard Schueler, began marketing Hex in 2018, positioning it as the first high-yield ‘blockchain certificate of deposit’. He touted Hex tokens as a tool designed to make people ‘rich’. The SEC, however, alleges that Heart, in addition to PulseChain, PulseX, and Hex, which are part of his crypto venture, have defrauded investors through unregistered securities offerings. He is also accused of misappropriating $12 million from these offerings to purchase luxury goods, such as a 555-carat black diamond known as “The Enigma”.

The SEC’s complaint claims that Heart deliberately tried to skirt securities laws by encouraging Hex investors to “sacrifice” crypto assets instead of investing them. This model comes under scrutiny in light of the Howey test, a test used to determine whether an asset qualifies as a security, implying that investors have a reasonable expectation of profits. According to the SEC, Heart’s strategies may have not passed this crucial test.

The Extravagant Spending Spree and Its Consequences

Heart’s spending habits became the focus of the investigation when the SEC revealed that the misappropriation of funds was linked to an offering for PulseChain, an unregistered venture that began in July 2021. Heart is alleged to have spent extravagantly on luxury items, including $534,916 on a McLaren sports car, $314,125 on a Ferrari Roma, and over $3.4 million on five Rolex watches.

Another offering, for PulseX, also came under the SEC’s scrutiny, with Heart once again predicting an appreciation of “10,000x in two years”. It’s essential to note here that, at present, Hex’s value has dropped about 98.4% below its all-time high, and the native tokens of both PulseChain and PulseX are practically worthless.

The SEC’s Demands and the Future of Crypto Regulations

The SEC’s lawsuit has been filed in the U.S. District Court for the Eastern District of New York. The commission has made clear demands: it seeks a jury trial, the recouping of ill-gotten gains, prejudgment interest, and the imposition of civil penalties. Moreover, it wishes to permanently ban Heart and his crypto projects from selling crypto asset securities.

This case serves as a stark reminder of the importance of regulatory compliance within the rapidly growing cryptocurrency industry. It highlights the dire consequences of neglecting to register security offerings and the potential risks investors face in an often speculative market. The verdict on this case could pave the way for stronger crypto regulations and perhaps shift the balance in the ongoing tug-of-war between crypto innovation and regulatory oversight.

Richard Heart’s case illustrates the grey areas of cryptocurrencies, shedding light on the crucial role that agencies such as the SEC play in maintaining a healthy and secure investment environment. As the saga unfolds, its implications for future crypto operations and regulations are yet to be seen, but one thing is certain: the world will be watching closely.