- Bitcoin’s sell-off stems from overlapping macro, regulatory, and investor-driven pressures.

- BTC hovers in the mid-$80,000s as traders wait for clarity on rate cuts and institutional flows.

- Analysts see caution ahead but no confirmed long-term trend reversal yet.

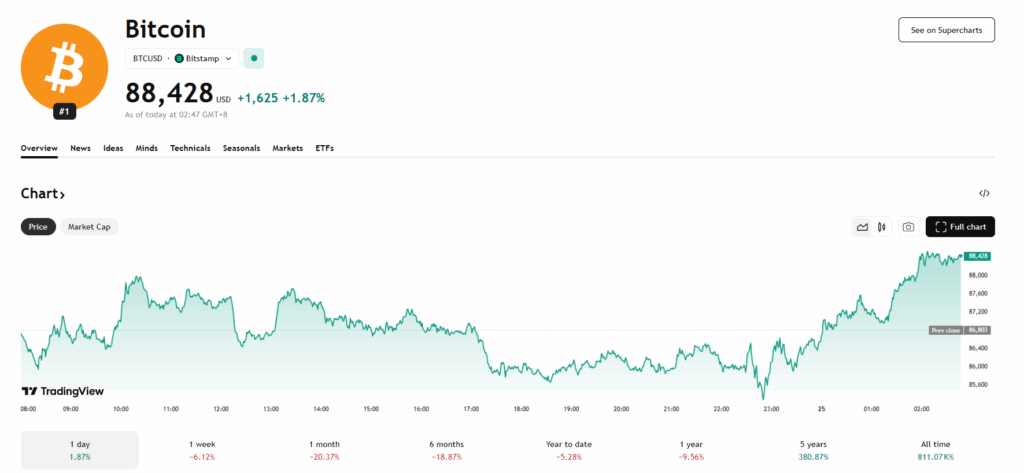

Bitcoin has officially delivered one of its harshest weekly declines of the year, falling more than 30% from last month’s highs and slipping into the mid-$80,000 range. The reversal caught traders off guard because momentum had looked strong just weeks earlier, with BTC printing new highs before rolling over sharply. As the market digests the downturn, Deutsche Bank analysts have stepped in with a clear explanation, pointing to five overlapping forces that continue to drag prices lower.

Five Pressures Weighing Down the Market

Analysts say Bitcoin is still being shaped by the wider risk-off mood spilling through global markets. Instead of acting like an uncorrelated asset, BTC has begun mirroring high-growth tech stocks, slipping whenever the Nasdaq-100 shows weakness. This is happening while the Federal Reserve maintains a cautious tone. Jerome Powell signaled that a December rate cut is not guaranteed, adding uncertainty at a time when traders need clearer cues. Although New York Fed President John Williams later softened expectations, the market remains uneasy.

Regulatory momentum has also slowed. Progress on the Digital Asset Market Clarity Act has stalled in the Senate, frustrating investors who were hoping for near-term clarity on market structure and oversight. At the same time, institutional players have begun withdrawing capital, reversing the inflow trend that supported Bitcoin during its earlier rally. Long-term holders have also been selling into strength, locking in profits and adding extra supply during a period of already weak demand.

Where Bitcoin Stands Now

Despite the sharp correction, Bitcoin has shown a modest bounce from weekend lows. It is currently hovering near the $86,000 region after closing around $84,535 on Friday. The lift has calmed some of the panic, but the broader atmosphere remains tense. Traders are watching every new macro headline for clues about rate decisions and liquidity conditions, two factors that could heavily influence Bitcoin’s next major move.

What Comes Next for BTC

Deutsche Bank’s view is that the downturn is not being driven by a single catastrophic catalyst but rather a cluster of pressures that hit the market all at once. Until there is a clearer direction on interest rates, regulation, and institutional positioning, volatility is likely to remain elevated. For now, analysts still see a cautious environment rather than a confirmed long-term trend reversal, but the next few weeks will determine whether this correction settles into stability or deepens further.