- Analyst Vincent Scott criticizes viral XRP predictions that promise fast millionaire outcomes without data or market context.

- Claims that 3,500 XRP could reach millionaire status would require a 14,000% move, which Scott calls unrealistic in the short term.

- Exaggerated forecasts spread easily on social media, while cautious, data-driven analysis tends to gain less attention.

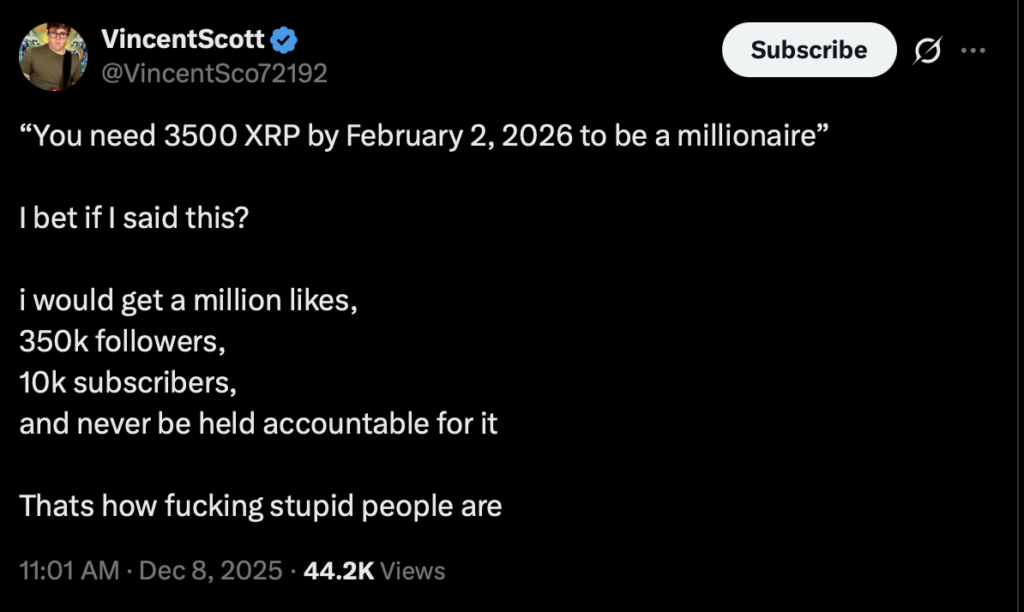

Growing frustration inside the XRP community is bubbling up again, this time around the nonstop flood of sensational price predictions making the rounds on social media. Industry analyst Vincent Scott recently called out what he sees as a worrying pattern — bold, eye-catching claims with very little substance behind them.

One example that really set him off was the idea that holding just 3,500 XRP could supposedly turn someone into a millionaire in a very short window. Scott didn’t mince words. To him, these kinds of statements aren’t analysis, they’re marketing, designed to trigger excitement rather than reflect reality.

Why Wild XRP Predictions Keep Going Viral

Scott explained that exaggerated forecasts thrive because they’re built for engagement. Big numbers grab attention, plain and simple. He admitted that if he posted a similar claim — even without evidence — it would likely rack up likes, followers, and paid subscribers almost instantly.

And here’s the problem. There’s usually no downside for the person making the claim. When the prediction fails, accountability is rare. The post quietly disappears, while the audience growth sticks.

According to Scott, many people sharing or endorsing these posts don’t stop to question whether the math or market logic actually works. They just see the upside and hit repost. Over time, this allows influencers pushing unrealistic narratives to grow their platforms, while analysts who stick to cautious, data-backed views tend to grow slower, even if they’re far more accurate.

A Familiar Pattern of Overreach

This isn’t a new issue. Scott’s comments fit into a broader trend of increasingly extreme XRP projections that surface every cycle. Earlier this year, a well-known Bitcoin supporter claimed early XRP holders were on the verge of “generational wealth,” enough to support entire families indefinitely. The claim spread fast, despite offering no real explanation of how or why.

Other predictions haven’t aged well either. Back in September, one XRP-focused analyst insisted that the approval of spot XRP ETFs would instantly create a wave of new millionaires. Reality played out very differently. After the ETFs launched in November, XRP actually dropped from $2.52 to $1.80, before later stabilizing above $2. Not exactly the overnight wealth explosion people were promised.

The most recent claim Scott addressed goes even further. It suggests that 3,500 XRP could reach millionaire status by February 2, 2026. For that to happen, XRP would need to trade near $286 per token, a move of more than 14,000%from current levels around $2.

Scott isn’t saying XRP can’t appreciate over the long term. He’s clear on that. But expecting that kind of price in a matter of weeks ignores liquidity constraints, regulatory realities, and basic historical growth patterns. In his view, the projection simply doesn’t hold up under scrutiny.

A Call for More Responsible Conversation

At its core, Scott’s criticism is about responsibility. Crypto already carries enough risk without layering on unrealistic expectations. He urges investors to slow down, question bold claims, and look for analysis rooted in data rather than hype.

Optimism isn’t the problem, he says. Context is. Big upside scenarios should come with realistic timelines, assumptions, and an understanding of market structure. Without that, predictions turn into noise.

Scott’s comments add to a growing push within the crypto space to draw a clearer line between informed analysis and viral content. The difference matters — especially for investors trying to make decisions in a market that already moves fast enough on its own.