- SUI faces a $265 million token unlock on May 1, releasing about 2.28% of the circulating supply, raising concerns about potential selling pressure after a strong recent rally.

- On-chain fundamentals remain strong, with SUI’s TVL climbing 40% to $1.73 billion, stablecoin market cap rising, and daily DEX volumes holding steady around $500 million.

- If SUI holds above $3.60, it could push toward $4.00, but selling pressure could trigger a pullback toward $3.30 or even $3.00 if the market struggles to absorb the unlock.

After a pretty explosive run-up, SUI might be about to face a serious test.

A $265 million token unlock is set for this week — and yeah, it could bring some serious selling pressure into the market.

74 Million SUI Unlock Incoming

On May 1, about 74 million SUI tokens — roughly 2.28% of the current circulating supply — will be unlocked, according to data from Tokenomist.

Now, just to keep things in perspective — only about 33% of the total SUI supply has been unlocked so far.

Meaning there’s still a lot of supply that could eventually hit the market.

This upcoming unlock comes right when demand for SUI has been heating up, so it’s setting up a bit of a showdown: can fresh buying appetite absorb the incoming supply without sending prices tumbling?

Fundamentals Are Firing Up

While the unlock could trigger some volatility, SUI’s on-chain fundamentals have been crushing it lately:

- Total Value Locked (TVL) on SUI protocols jumped 40% since early April, now sitting at $1.73 billion (per DeFiLlama).

- The stablecoin market cap on Sui’s network climbed from $630 million to $880 million.

- Daily DEX volume has been floating around $500 million — not too shabby.

- Over the past week alone, the network’s handled more than $3.6 billion in trading, pushing monthly volumeabove $11 billion.

So, despite the token unlock looming, some traders actually see the strengthening fundamentals as a reason to stay bullish — betting that SUI can absorb the pressure without much damage.

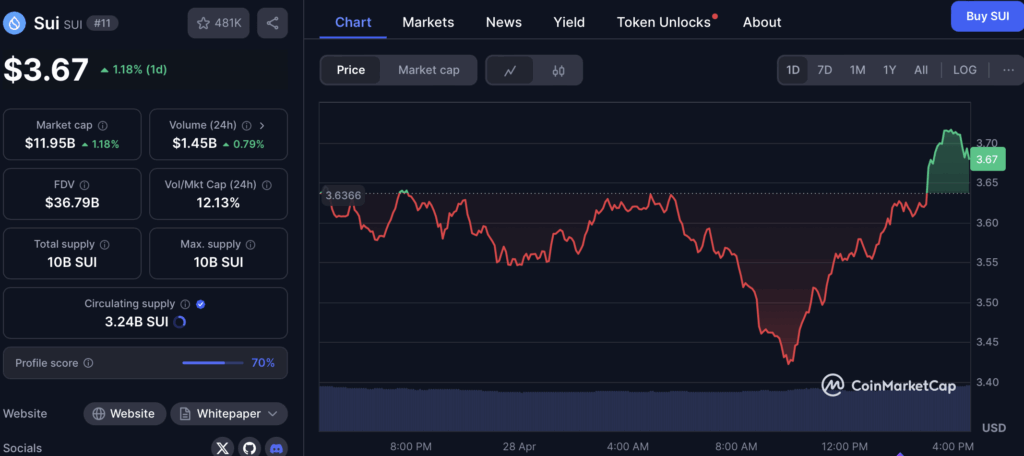

Current Price Action: Bullish, But Caution Creeping In

At the time of writing, SUI is trading around $3.62, after smashing through the $3.30 resistance zone last week.

Key indicators still look pretty bullish:

- RSI is sitting at 78, which is technically overbought — so maybe a little overheated, but not a crash signal on its own.

- Momentum indicators are still favoring the bulls.

- MACD? Still sitting nice and positive.

- All major moving averages continue flashing “buy” signals too.

Key Levels to Watch

Here’s how it could play out:

- If buying pressure holds: SUI might take a shot at the $4.00 psychological level next. A clean break there could fire up more momentum traders.

- If selling pressure kicks in: SUI could slip back to $3.30 support — that’s the previous resistance zone it just broke out of.

- In a deeper pullback: Eyes would be on the $3.00 level, near the 10-day EMA, as stronger support.

If the market soaks up the unlock without much drama?

SUI could settle into a new range between $3.30 and $3.60 before plotting its next big move.

Final Thoughts: Big Test Ahead for SUI

The stage is set for a critical week.

Between the bullish technicals, the growing fundamentals, and the $265M unlock, SUI’s about to find out just how strong its rally really is.