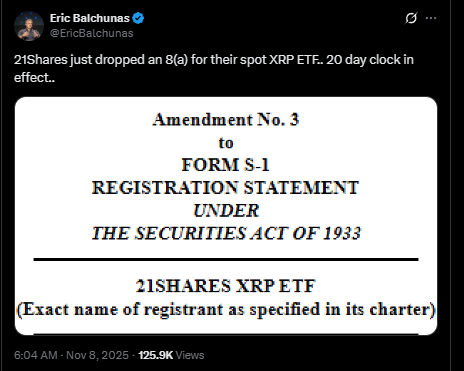

- 21Shares just filed Amendment No. 3 for its spot XRP ETF under Section 8(a), starting a 20-day SEC review window where the fund could auto-approve around November 27 if the SEC does nothing.

- XRP jumped about 5% to $2.32 on the news, while Franklin Templeton, Grayscale, and Canary Capital all moved their own XRP ETF plans forward, targeting mid–late November launch windows.

- RippleNet pushed $57.7B in payment volume last quarter, XRP trades around $2.20 with a ~$134B market cap, and a spot ETF would put it on the same shelf as Bitcoin and Ethereum for traditional investors.

XRP jumped about 5% to $2.32 after 21Shares dropped Amendment No. 3 to its Form S-1 for a spot XRP ETF, and yeah, the market noticed fast. The filing was made under Section 8(a) of the Securities Act of 1933, which basically means a 20-day review clock starts ticking the moment it hits the SEC’s desk. If the SEC doesn’t step in with a delay, comment, or stop order during that period, the ETF can technically go effective automatically. ETF analyst Eric Balchunas flagged the move on X, while trader Scott Melker pointed out that this setup could put a potential go-live date somewhere around November 27 if regulators stay quiet.

The XRP community reacted in a pretty familiar way: buying first, debating later. Trading volumes pushed higher as price moved up from its previous level, with some traders already talking about “god candles” if an approval or auto-effect date lines up with strong market sentiment. People still remember July 2023, when Judge Analisa Torres issued a partial ruling favoring Ripple and XRP spiked around 70% almost overnight. That kind of move sits in the back of every trader’s mind when a new catalyst like an ETF pops up.

XRP ETF Race Heats Up: 21Shares, Franklin, Grayscale, Canary

21Shares isn’t moving in a vacuum here; its amendment comes just days after Franklin Templeton and Grayscale tweaked their own XRP ETF filings. Franklin Templeton removed earlier regulatory language from its S-1, dropping the explicit Section 8(a) clause that had previously required more direct SEC sign-off before launch. A lot of analysts see that adjustment as the firm quietly positioning itself for a November rollout, depending on how the SEC mood swings.

Grayscale, meanwhile, filed a second amendment for its XRP Trust conversion, locking in key executives and legal counsel. That type of housekeeping usually happens closer to an expected launch window, not at the very start of a process. On top of that, Canary Capital is aiming for a November 13 debut for its XRP ETF, pending final approval from Nasdaq. Put together, you’ve got multiple issuers circling similar dates, which gives this month a “something’s going to break here” kind of feeling for XRP ETF watchers. If even one of these funds goes live, XRP would officially stand next to Bitcoin and Ethereum in the spot ETF lineup.

XRP Fundamentals, Payment Volume And Market Context

Beyond the filings and hype, XRP is still sitting in a pretty big ecosystem. RippleNet processed about $57.7 billion in total payment volume in the quarter ending September 30, 2025. That’s way smaller than PayPal’s $458.1 billion over the same period, but it still shows meaningful usage for a network that leans on speed and low fees rather than consumer branding. XRP is currently trading around $2.20 after previously tagging an all-time high of $3.56 in July, which gives it a market cap of roughly $134 billion based on circulating supply.

If you zoom out to the full 100 billion XRP created at launch, the fully diluted value sits near $220 billion, with Ripple still holding around 40 billion coins in reserve accounts. The number of XRP accounts has stayed steady, and RippleNet continues to operate as an international payment rail working with banking and fintech partners. If one or more spot XRP ETFs actually go live this month, they’d add a new on-ramp for institutional and retail capital that doesn’t want to deal with exchanges directly. That doesn’t guarantee a “god candle” or anything, but it definitely changes how easily big money can rotate into XRP when the narrative heats up.