- Nasdaq officially listed Canary Capital’s spot XRP ETF (XRPC), launching Nov. 13 even amid the U.S. government shutdown.

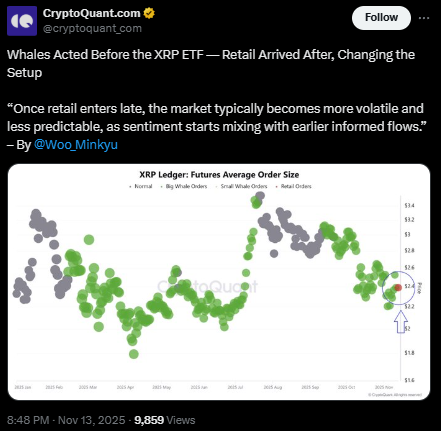

- CryptoQuant detected whales accumulating XRP before the ETF announcement, signaling early positioning.

- Retail traders rushed in afterward, increasing volatility and potentially setting up an XRP rebound from the ~$2.46 level.

The XRP market just got a fresh jolt of excitement after Nasdaq officially listed Canary Capital’s spot XRP ETF — ticker XRPC — and according to CryptoQuant, some whales didn’t even wait for launch day. They were already piling in early, almost like they knew momentum was about to shift. The timing felt a bit too perfect, and now analysts are trying to piece together how much of this move was smart money positioning… and how much was pure speculation bubbling up.

ETF Launch Goes Live Despite U.S. Shutdown Noise

On November 12, Nasdaq confirmed in a filing with the SEC that the Canary XRP ETF had been certified for trading. It officially goes live on November 13 under ticker XRPC, marking one of the rare ETF approvals that managed to push through even while parts of the U.S. government weren’t running at full capacity. Usually, ETF paperwork slows down during shutdowns — but crypto seems to be in its own lane lately.

This ETF has been sitting on the SEC’s desk since October 2024, waiting for a response. The fund is designed to track the price of XRP using the CME CF Ripple Index and will not rely on any derivatives — something Canary Capital emphasized to reduce counterparty risk. Interestingly, XRPC was also one of the five XRP ETFs spotted earlier on DTCC’s list alongside filings from Franklin Templeton, Bitwise, 21Shares, and CoinShares.

Whales Moved Early — But Retail May Be the Real Wildcard

CryptoQuant noted something pretty telling: whale inflows picked up before Nasdaq publicly confirmed the XRPC listing. The pattern looked like early positioning, with big buyers stepping in while XRP’s price was still relatively quiet and compressed. But according to CryptoQuant, this pre-launch activity isn’t even the main story anymore.

Once the ETF announcement hit, retail traders piled in — and that’s when markets typically stop behaving cleanly.

“When retail enters late, the market becomes more volatile and less predictable,” CryptoQuant explained, because now sentiment mixes with informed flows, creating messy price action.

In other words, whales may have moved early… but retail is the one who shakes the table afterward. With XRP trading around $2.46, analysts think the XRPC launch could be the spark that leads the next rebound if momentum builds from here.