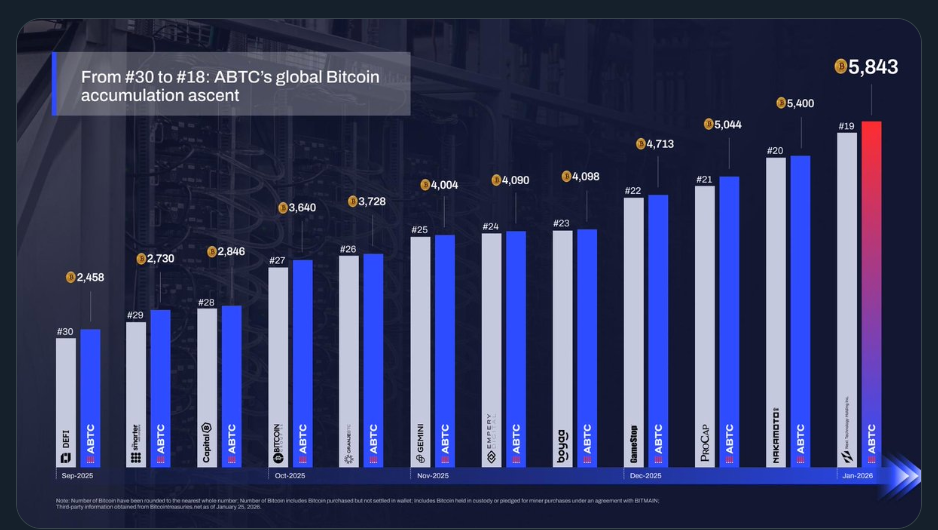

- American Bitcoin jumped from #30 to #18 in global corporate Bitcoin holdings in under five months

- Eric Trump is positioning BTC accumulation as a competitive metric, not a narrative

- The message targets legacy finance as much as the crypto industry

Eric Trump’s statement was designed to travel fast and land clearly. By listing companies American Bitcoin has overtaken, the message avoids vision talk and sticks to numbers. This is accumulation as evidence. Moving close to 5,900 BTC in under five months reframes the company from a speculative entrant into a serious balance-sheet player.

Bitcoin treasuries are no longer novelty experiments. They are becoming scoreboards, and speed matters as much as size.

Why the Comparison to Wall Street Matters

Calling out firms like GameStop and pointing toward Galaxy Digital is intentional. Galaxy represents institutional crypto finance, not retail enthusiasm. By framing American Bitcoin against that benchmark, the signal is clear: this is not just about mining or holding BTC, but about competing inside traditional capital markets with crypto-native balance sheets.

The Nasdaq listing reinforces that comparison. This is Bitcoin accumulation meant to be legible to Wall Street, not just crypto Twitter.

The Political Subtext Beneath the Strategy

The language around “America’s Bitcoin infrastructure” is not accidental. It taps into broader themes of domestic capital, financial sovereignty, and competition with global systems. Whether or not the framing resonates universally, it aligns Bitcoin accumulation with national and institutional relevance rather than counterculture narratives.

Conclusion

Eric Trump’s message is not a victory lap. It is pressure. It challenges competitors to keep pace and signals to institutions that Bitcoin accumulation is becoming a race, not a debate. If American Bitcoin sustains this trajectory, the real story will be which firms realize too late that speed has become the advantage.