- Solana has slipped into a corrective phase after repeated rejection near $144

- The $119 level is emerging as a critical support zone to watch

- Holding $119 could signal a healthy correction, while losing it risks deeper losses

The broader crypto market is under pressure, and Solana hasn’t been spared. Selling momentum has kept SOL deep in the red, with price continuing to slide as traders de-risk across major assets. On January 25, crypto analyst Ali Martinez shared fresh observations suggesting Solana may not be done correcting yet, warning that downside pressure could drag price back toward its 2025 lows.

The tone around SOL has shifted pretty quickly. What started as a strong rally earlier in the month is now looking more like a drawn-out pullback, with market participants watching closely to see whether this move stabilizes, or slips into something heavier.

Solana Starts Carving Out a New Support Zone

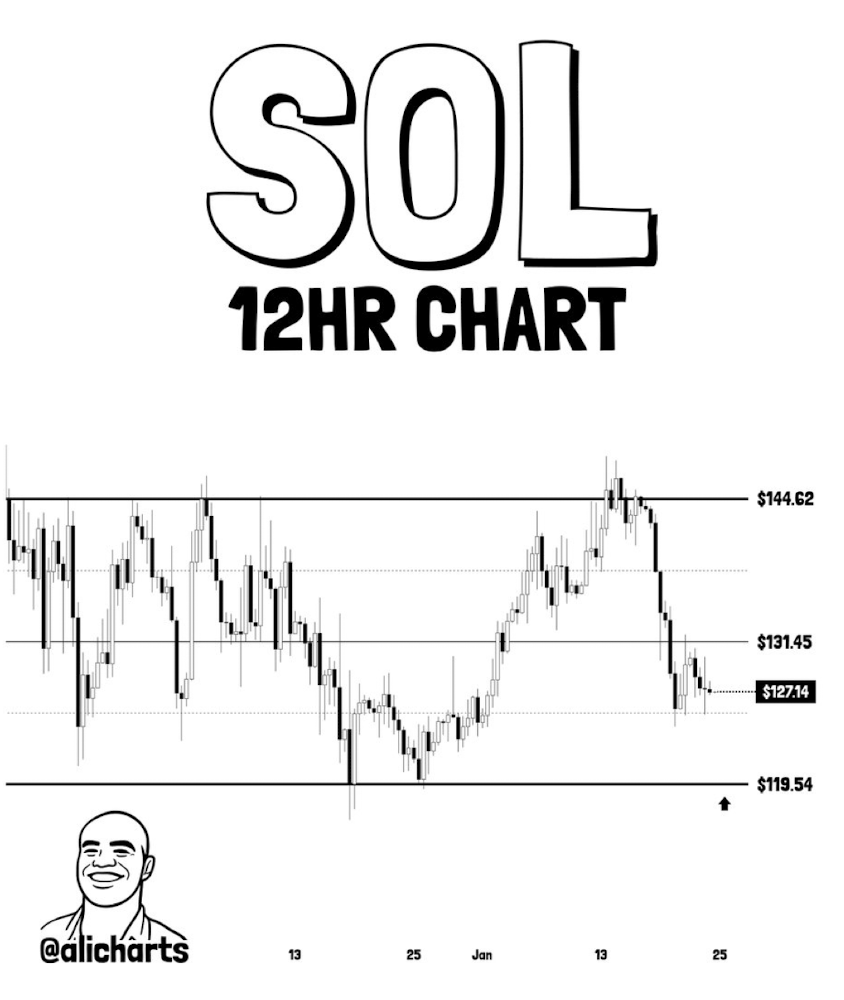

According to Martinez, Solana is showing signs of an extended correction phase, both technically and on-chain. After surging to highs near $144.62 last week, SOL ran straight into strong resistance and was rejected repeatedly around the $144 area. That rejection flipped sentiment fast, pushing price back below intermediate support near $131.45.

From there, the slide continued. Solana is now trading around the $127 zone, well below recent highs and still struggling to regain traction. The structure suggests sellers remain in control for now, and unless momentum shifts, further downside can’t be ruled out. One level, though, is starting to stand out more than the rest.

Why $119 Has Become the Key Level

The $119 area is now firmly on traders’ radar. Martinez pointed out that this zone has historically acted as strong demand, where buyers stepped in aggressively to absorb supply and trigger rebounds. Heavy accumulation around that level in past cycles makes it a natural place to watch if selling pressure continues.

If SOL revisits $119, the reaction there will matter a lot. A strong bounce could reinforce the idea that this move is still just a healthy correction following a sharp rally. On the other hand, failure to hold that zone would open the door to deeper losses, shifting the narrative away from correction and closer to trend deterioration.

Correction or Something More?

It’s worth noting that this drawdown comes right after a powerful upside move earlier in the month. In that context, the decline may simply reflect profit-taking and cooling momentum rather than a full reversal. Markets often need these resets, even if they feel uncomfortable in real time.

Still, the risk is clear. If Solana breaks and closes below $119 with conviction, downside pressure could accelerate, forcing price to search for lower support. For now, SOL sits in a fragile spot, with traders watching closely to see whether buyers step back in, or whether the correction has more room to run.