- Solana ETFs recorded their first outflow on January 16 before rebounding with $9.5M in inflows

- SOL price fell over 7.7% this week, returning to a long-standing consolidation zone

- On-chain activity remains resilient, driven in part by strong growth in RWAs

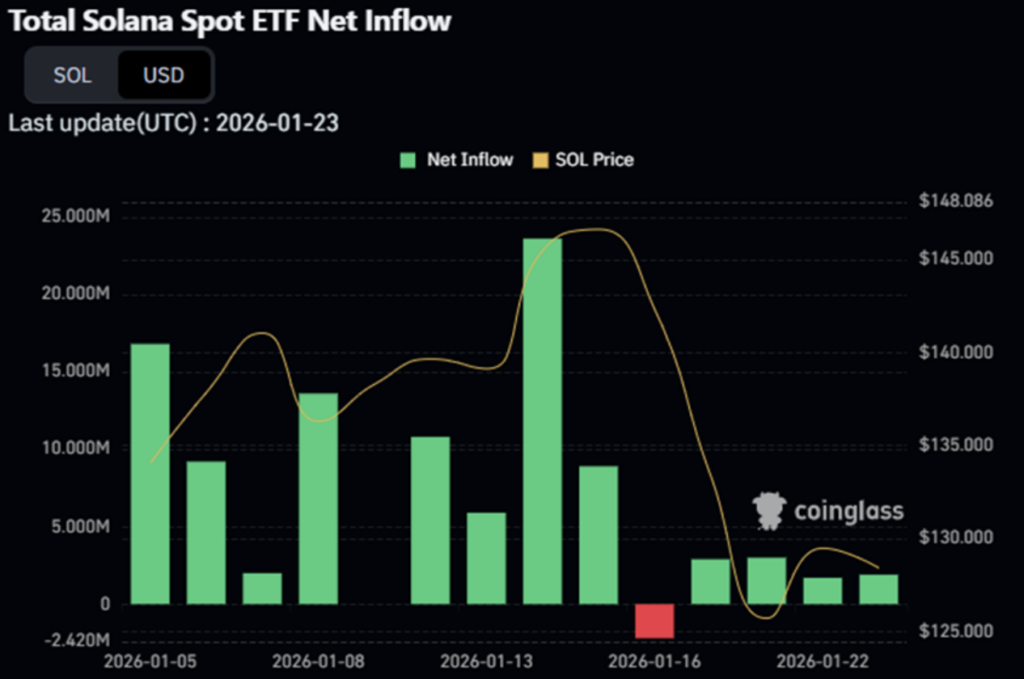

Solana ETFs had a brief wobble last week after recording their first-ever outflow on January 16. For a product that had maintained an uninterrupted run of positive flows, that single dip was enough to raise eyebrows. Some analysts began questioning whether institutional demand was starting to cool.

The hesitation didn’t last long. By the end of the week, spot Solana ETFs were back in positive territory, adding roughly $9.5 million worth of SOL between Tuesday and Friday, according to CoinGlass. Monday registered no activity due to the U.S. holiday. Even so, the rebound was modest, and notably smaller than inflows seen earlier in January, hinting that uncertainty is still influencing behavior.

SOL Price Slips Back Into Its Consolidation Zone

Despite ETFs turning green again, SOL’s price moved in the opposite direction. The token faced steady selling pressure, dropping more than 7.7% over the past seven days. That decline extended bearish momentum from the prior week and pushed price back toward familiar territory.

At the time of writing, SOL was trading near $127, right inside its previous consolidation range and close to a six-month low. While the short-term trend looks weak, momentum indicators such as RSI and MFI still suggest underlying strength, a combination that often points to quiet accumulation rather than outright capitulation.

This same zone has acted as strong support since April 2024. SOL did briefly break below it in March 2025, but that move was driven by broader macro pressure. A similar breakdown now would likely require demand to dry up further, and so far, investors appear cautious rather than fearful.

Network Activity Holds Up Under Market Pressure

On-chain data tells a more resilient story. Solana’s total value locked slipped from a mid-month high of $9.1 billion to around $8.28 billion, a typical response during periods of market stress. But not all activity cooled.

Solana’s DEX revenue jumped by more than $28 billion this week, marking an 11-week high, even as SOL’s price moved lower. That divergence suggests users are still active, trading and interacting with the network despite weaker sentiment.

Address activity and weekly transactions also remained elevated, though slightly below last week’s peak. This confirms that Solana’s ecosystem hasn’t gone quiet, even as price action struggles.

RWAs Continue to Drive Usage on Solana

A key contributor to this strength appears to be real-world assets. According to data from RWA.xyz, Solana’s RWA segment continues to expand. Thirty-day stablecoin transfer volumes on the network surged more than 43%, while RWA holder counts rose by 12%.

By late 2025, the total value of RWAs on Solana had crossed the $1 billion mark. That growth has helped support network usage during a period when broader market conditions remain uncertain.