- XRP remains under pressure as broader market weakness and retail selling weigh on sentiment

- Ripple’s RLUSD listing and ecosystem progress support long-term fundamentals, not short-term price

- Institutional inflows contrast retail caution and may help XRP form a recovery base

XRP continues to trade under pressure, weighed down by broader weakness across the crypto market. The token is still locked in a short-term downtrend, shaped by macro uncertainty and lingering skepticism from investors who remain unconvinced about a near-term turnaround. That hesitation is visible in price action, which has struggled to find consistent upward momentum.

Still, not everything under the surface looks negative. Ripple’s ongoing operational progress continues quietly in the background, offering a potential foundation for longer-term price stability. While the market remains focused on short-term moves, fundamentals are slowly building.

Ripple Expands RLUSD With Binance Listing

Ripple recently confirmed that its U.S. dollar-backed stablecoin, RLUSD, has been listed on Binance. This is a meaningful step, as broader exchange access improves visibility and makes the stablecoin easier to use at scale. As stablecoin adoption accelerates globally, exposure on a major platform like Binance matters more than it might seem at first glance.

For now, RLUSD operates on Ethereum, but future expansion to the XRP Ledger could be a turning point. An XRPL integration would likely boost on-chain activity, transaction demand, and real utility across Ripple’s ecosystem. That kind of growth wouldn’t lift XRP overnight, but it does strengthen the long-term narrative around the network.

XRP Holders Continue to Sell Into Weakness

Despite these developments, XRP holders remain cautious. On-chain data shows net realized profit and loss has turned negative in recent sessions, meaning investors are selling at a loss. This behavior usually signals fear of further downside rather than confidence in a quick rebound.

Retail hesitation can be stubborn. Selling into weakness often slows momentum shifts, even when fundamentals are improving elsewhere. Until confidence begins to stabilize, Ripple’s progress may struggle to translate into immediate price appreciation for XRP.

Institutional Investors Show a Different Story

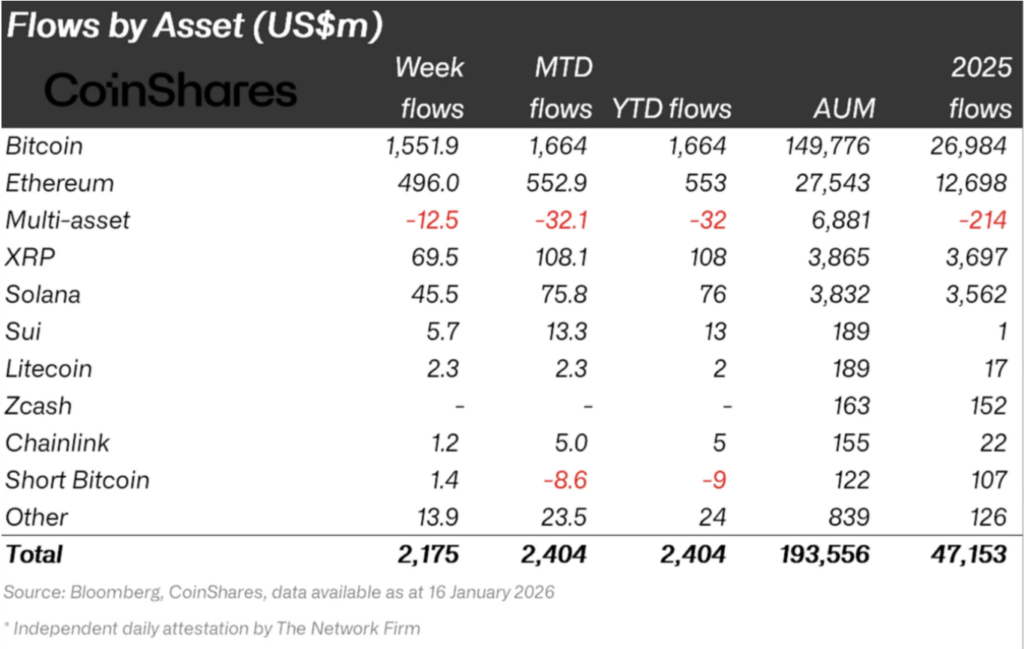

Institutional flows tell a very different story. For the week ending January 16, XRP recorded $69.5 million in inflows, with month-to-date figures reaching $108.1 million. That accumulation has continued even as XRP remains stuck in a downtrend, which is notable.

Large investors often build positions during periods of pessimism, well before sentiment shifts. Consistent inflows help support liquidity and reduce downside risk over time. This growing gap between cautious retail behavior and steady institutional demand could eventually help XRP form a recovery base.

XRP Must Break Its Downtrend to Shift Momentum

XRP is trading near $1.96 at the time of writing, still capped by a downtrend line that has held for more than two weeks. Technical pressure hasn’t disappeared, but improving fundamentals and institutional accumulation increase the odds of a breakout attempt. A clean move above the downtrend would mark a meaningful change in short-term structure.

If XRP can reclaim the $2.00 level, momentum could carry it toward $2.03 and potentially $2.10. With stronger follow-through, a recovery toward the $2.35 area becomes realistic. On the flip side, failure to hold above $2.00 could invite renewed selling pressure, opening the door to $1.86 or lower and extending the current downtrend.