- Bermuda plans to pilot a fully on-chain national financial system

- Stablecoins like USDC will replace traditional payment rails

- Education and phased adoption are central to the rollout

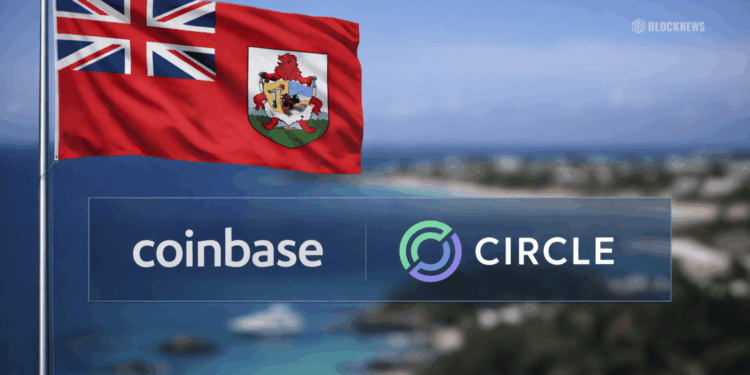

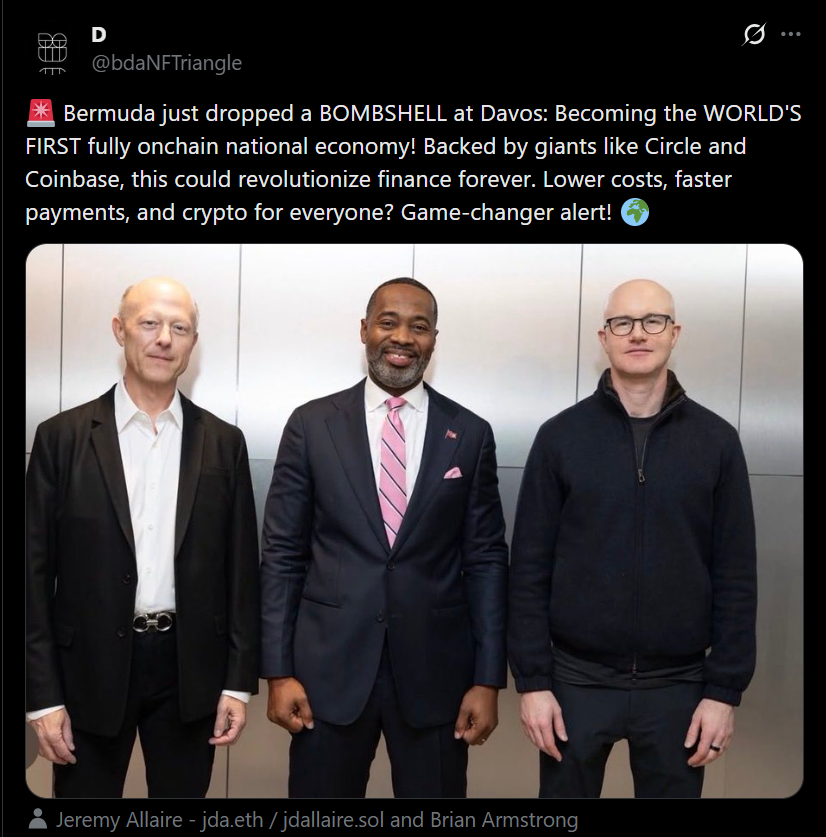

At the World Economic Forum in Davos, Bermuda quietly laid out one of the boldest financial experiments attempted by any nation so far. The island nation announced a partnership with Coinbase and Circle aimed at pushing its entire economy onto blockchain rails. This isn’t a branding exercise or a pilot hidden in a sandbox. The goal is to make on-chain infrastructure a core part of how money moves across the country, from government payments to everyday commerce.

Stablecoins Are the Backbone, Not the Bonus

What makes Bermuda’s plan stand out is its specificity. Rather than vague promises about innovation, the initiative focuses on stablecoins, particularly USDC, as a replacement for traditional payment rails. Government departments will begin piloting stablecoin payments, while local merchants are encouraged to accept USDC directly. Banks and insurers are also being brought into the mix, with tokenization tools designed to modernize asset issuance and settlement.

For an island economy that routinely absorbs high card fees and slow settlement times, the appeal is obvious. Stablecoins move faster, cost less, and don’t rely on layers of intermediaries that quietly tax every transaction.

Education Comes Before Full Adoption

Bermuda’s leadership appears to understand that technology alone doesn’t guarantee success. Trust, familiarity, and usability matter just as much. Before any nationwide rollout, the country plans to invest heavily in digital finance education and onboarding. Pilot programs are designed to ease citizens into the system rather than forcing abrupt change. Even the USDC giveaways at Davos were a signal of that phased approach, testing behavior before scaling infrastructure.

A Smart Experiment With Real Risks

There’s no denying the ambition here. Bermuda is leveraging its crypto-friendly regulatory environment to test whether decentralized systems can support real economic activity at a national level. At the same time, replacing familiar banking rails with blockchain-based tools introduces risk. Not everyone is comfortable with digital wallets, private keys, or stablecoin mechanics, and adoption gaps could quickly turn into social friction if not handled carefully.

Why This Actually Matters

The true measure of success won’t be the announcement or the partners involved. It will be whether this system delivers cheaper payments, smoother settlement, and broader access without excluding people who struggle to adapt. If Bermuda succeeds, it offers a working blueprint for other small nations and even larger economies exploring alternatives to legacy finance. If it fails, it will still provide valuable lessons about the limits of on-chain systems in the real world.

The Bigger Picture

This move isn’t about chasing crypto hype cycles. It’s about rethinking the financial backbone of a country from the ground up. Bermuda is betting that stablecoins and tokenization can do what traditional rails struggle with in small, fee-sensitive economies. Whether that bet pays off will depend less on technology and more on people, trust, and execution.