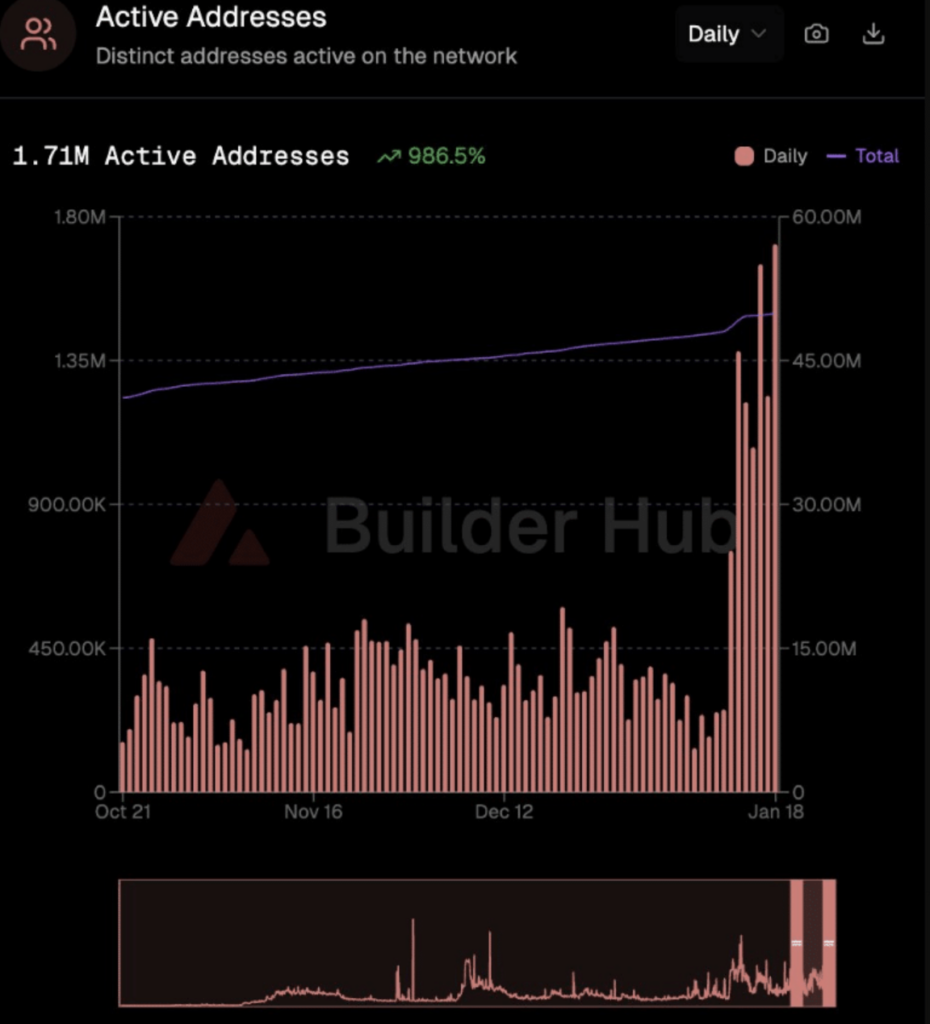

- Avalanche’s growth is being driven by real on-chain usage, with Daily Active Addresses reaching 1.7 million across DeFi, tokenization, and RWAs

- Strong Taker Buy dominance and whale accumulation near $12 signal conviction rather than short-term speculation

- AVAX remains structurally bullish above $12, with upside potential if key resistance levels are reclaimed

Investor attention has shifted away from quick price spikes and toward something more durable, actual project growth. Avalanche (AVAX) sits right in the middle of that shift. The network recently crossed 1.7 million Daily Active Addresses, a number driven less by hype and more by usage across DeFi, tokenization, and real-world asset activity. That kind of participation doesn’t show up overnight, and it’s one reason AVAX price responded positively.

What makes this cycle feel different is the quality of demand. Instead of speculative bursts, Avalanche’s growth is being backed by institutional filings, steady capital allocation, and real deployments. As blockchain demand expands, Avalanche is quietly positioning itself as infrastructure built for scale, not just speed. The bigger question now is whether this traction can hold as AVAX looks ahead into 2026.

Taker Buy Pressure Keeps Bulls in Control

One of the clearer signals supporting AVAX’s strength has been persistent Taker Buy dominance. Throughout January 2026, aggressive buyers continued stepping in, especially during dips. When price slipped below $12, buying pressure didn’t disappear. It actually increased.

That behavior matters. Rising Taker Buy volume during pullbacks usually points to conviction, not hesitation. Traders weren’t waiting for perfect entries, they were committing capital. Even with short-term volatility, this steady flow of buy-side aggression helped keep AVAX supported and prevented deeper breakdowns. It’s not explosive momentum, but it’s consistent, and that tends to age better.

Why Whales Keep Defending the $12 Zone

On-chain data adds another layer to the story. Whales have shown a clear interest in the $12 region. When AVAX briefly dipped to $11.32, large holders stepped in aggressively, soaking up supply and pushing price back above support.

That kind of behavior usually signals long-term confidence rather than short-term trading. Whales don’t chase strength, they buy where they believe value sits. Their activity around $12 suggests that this level is being treated as a structural floor, even as broader market conditions remain uneven. As long as that zone holds, downside risk stays more contained.

Can AVAX Carry This Momentum Forward?

From a technical standpoint, AVAX has been holding its ground. Price remains above $12, and the daily chart hints at an ascending triangle forming. That structure often favors continuation, but only if resistance gives way. The first major hurdle sits near $15.36. A clean break there could open the path toward $18.52, with extension targets stretching as high as $24.18 if momentum builds.

Still, it’s not a one-way street. RSI and MACD have shown early signs of cooling, suggesting the rally may need to breathe. If support fails and AVAX drops below $11, the chart opens up downside risk toward $8.60. For now, the setup leans constructive, but confirmation matters.

As AVAX moves deeper into 2026, traders and investors alike will be watching the same thing: whether real usage, whale conviction, and sustained buy pressure can keep pace with rising price expectations.