- Crypto’s Trump-driven narrative has largely run its course

- Institutional capital is now shaping market structure and risk

- Bitcoin is hardening as a reserve asset while altcoins face higher standards

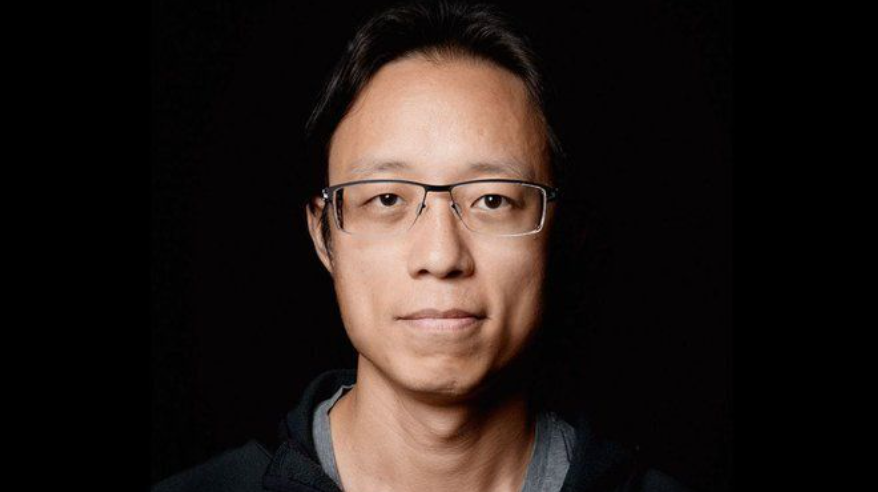

Crypto’s 2025 price action leaned heavily on expectations tied to Donald Trump. Pro-crypto rhetoric, policy hints, and political momentum mattered more than fundamentals for much of the year, and markets reacted quickly, sometimes emotionally. According to Animoca Brands chairman Yat Siu, that dependence was a mistake. In his view, crypto relied too much on political hope instead of structural reality, and once those expectations cooled, the market was forced to reassess what actually drives long-term value.

Institutions Are Rewriting the Rules

Siu argues that institutional capital is no longer a background force in crypto markets. It is now shaping how assets trade, how risk is priced, and how investors think about time horizons. Bitcoin is increasingly being treated as a reserve-style asset rather than a campaign-driven trade, and that shift is already changing behavior across the market. Altcoins, in particular, are under pressure. Narrative alone no longer works, and projects are being forced to prove economic relevance, cash flow potential, or strategic utility.

Even Animoca Brands is adjusting to this reality. Siu notes that the company is positioning itself more like a digital asset treasury than a pure growth or hype-driven operation, reflecting a broader move toward discipline and balance-sheet thinking.

Crypto and AI Are Starting to Converge

Beyond market structure, Siu points to a deeper trend forming between crypto and artificial intelligence. Autonomous AI agents need neutral, censorship-resistant rails to operate independently, and crypto networks fit that requirement far better than traditional financial systems or closed platforms. From this perspective, owning crypto could become a practical hedge on AI adoption, especially if agents begin managing assets and executing decisions without centralized control.

This is less about speculation and more about infrastructure. If AI systems are expected to act autonomously, they need financial rails that cannot be switched off arbitrarily, and crypto may be the most direct option available.

Why Hong Kong Still Plays a Key Role

From his base in Hong Kong, Siu sees a unique combination of deep capital markets, regulatory reach, and proximity to Asia’s major tech hubs. That mix gives the region an edge as institutions build globally connected digital finance infrastructure, particularly as crypto markets mature and integrate more deeply with traditional finance.

What the Shift Really Means

The Trump-driven phase gave crypto momentum and attention. Institutions are now giving it structure and direction. As politics fades into the background, fundamentals are starting to matter again, and markets are becoming more selective. From here, crypto looks less like a headline trade and more like a system being shaped by long-term capital.