- Over $864M in liquidations hit crypto markets in 24 hours, mostly from long positions.

- Bitcoin and Ethereum led losses as prices retraced sharply.

- Geopolitical tariff threats added pressure and fueled risk-off behavior.

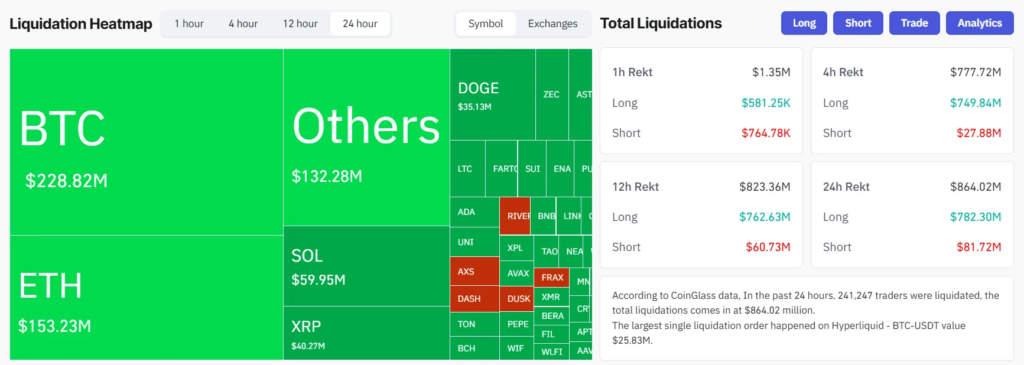

Crypto markets saw a sharp surge in volatility over the past 24 hours, with liquidations climbing past $864 million, according to CoinGlass data. More than 241,000 traders were impacted as prices moved quickly against leveraged positions. Long trades absorbed the majority of the damage, accounting for roughly $782 million in losses as bullish positioning unwound across major assets.

Bitcoin and Ethereum Lead the Liquidation Wave

The broader market downturn pushed total crypto market capitalization down nearly 3% to around $3.2 trillion, per CoinGecko. Bitcoin slid from above $95,000 to near $92,000, triggering about $229 million in liquidation losses. Ethereum followed closely, with roughly $153 million wiped out as ETH retraced alongside the broader market. The largest single liquidation was a $25.8 million BTC-USDT position on Hyperliquid, highlighting how concentrated leverage had become.

Geopolitical Tensions Spill Into Crypto

The selloff coincided with rising geopolitical uncertainty after US President Donald Trump threatened new tariffs targeting Denmark and key European allies amid the Greenland dispute. The proposal outlines an initial 10% tariff set to take effect in February, with the possibility of escalating to 25% by June if negotiations stall. Trump argued the measures are necessary, citing long-standing defense commitments and Greenland’s strategic role in countering foreign influence and supporting the proposed “Golden Dome” missile defense system.

Why Long Positions Took the Hit

The structure of losses suggests the market was leaning heavily bullish going into the week. As prices slipped, liquidation cascades accelerated downside moves, forcing long positions to close rapidly. This kind of reset is typical during periods of macro-driven uncertainty, where traders reduce exposure rather than absorb additional risk.

What Comes Next

While the liquidation event was severe, it also cleared a significant amount of leverage from the system. That reset can reduce near-term volatility if prices stabilize, though lingering macro and geopolitical risks could keep traders cautious. For now, crypto markets appear to be digesting external pressure rather than reacting to any crypto-specific breakdown.