- Whales accumulated over 210 million ADA below $0.40, signaling positioning rather than momentum chasing

- ADA continues to hold near the lower end of a long-term descending channel around $0.38

- Derivatives data shows easing bearish pressure, but trend strength remains weak

Something interesting is happening beneath Cardano’s price, even if the chart hasn’t reacted yet. Over the past three weeks, large holders have accumulated more than 210 million ADA, according to on-chain data. What stands out is when this buying happened. ADA was trading below $0.40, not breaking out, not chasing momentum. That kind of behavior usually points to positioning rather than reaction.

Whales tend to step in when downside pressure starts to fade, not when price is already moving. And while ADA hasn’t pushed higher yet, that divergence matters. Exchange balances slipped modestly during the same period, which means less liquid supply sitting on the sidelines. With fewer tokens readily available, even small increases in demand can start to matter more. This setup often shows up near structural turning points, though accumulation by itself doesn’t move price. It just sets the stage.

ADA Presses Against the Bottom of a Long-Term Channel

At the time of writing, Cardano continues to trade inside a multi-month descending channel, hugging the lower boundary around $0.38 to $0.39. Price has tested this area repeatedly and, so far, has refused to make lower lows. That’s a subtle but important change. Sellers appear less aggressive, even if buyers haven’t taken control.

Volatility has compressed as candles bunch up near channel support. That kind of compression rarely lasts. Markets tend to resolve these conditions with expansion, one way or the other. On the upside, prior structure places key levels around $0.47 and then $0.60. Until ADA exits the channel, direction remains open. Still, the current location favors asymmetry rather than a clean continuation lower.

Trend Signals Hint at Stabilization, Not Momentum

The Directional Movement Index offers a similar message. The +DI has edged above the –DI, giving buyers a slight directional advantage. But ADX remains low, sitting near 17. That tells us something important. Buyers may be in control of direction, but they don’t yet have trend strength.

This combination often shows up during basing phases. Sellers stop pushing, buyers start absorbing, and price drifts sideways instead of trending. If ADX expands above 25, momentum could follow quickly. Until then, the data supports stabilization, not confirmation. The positive part is that downside momentum continues to weaken.

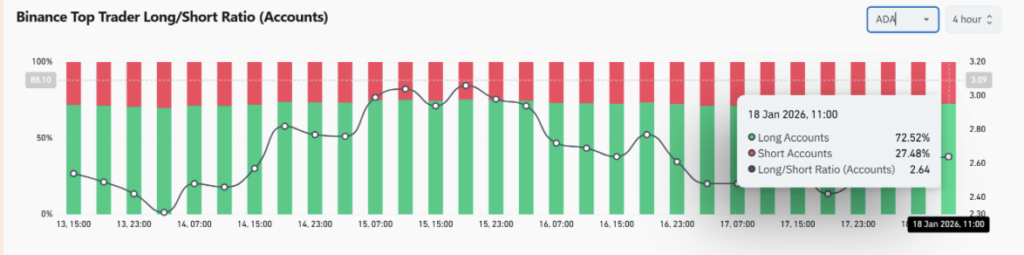

Top Traders Lean Long, but Without Excess

Looking at Binance top trader positioning adds another layer. About 72.5% of top trader accounts are positioned long, compared to just under 27.5% on the short side. That’s a clear skew, and it reflects confidence among experienced participants rather than retail chasing.

It’s worth noting that this metric tracks account bias, not position size. So it speaks more to sentiment than outright leverage risk. Top traders often position early, ahead of structural shifts, rather than waiting for breakouts. That said, a heavy long skew does increase sensitivity to volatility. If price stalls for too long, some of that exposure could unwind. For now, though, the positioning looks like conviction, not excess.

Funding Rates Cool as Short Pressure Fades

Funding data supports that view. The OI-weighted funding rate has turned slightly positive at around +0.0018%, recovering from an extended period below zero. This suggests short-side pressure has eased meaningfully. Traders are no longer being paid to hold bearish positions.

Importantly, funding remains modest. That reduces the risk of overheating and keeps leverage conditions balanced. Longs aren’t dominating funding costs, but shorts have lost incentive. Markets in this state often transition out of defensive phases slowly, rather than snapping higher. Funding alone won’t drive price, but it removes friction.

The Bigger Picture for Cardano

Taken together, Cardano is showing early signs of stabilization. Whales are accumulating, price is holding near $0.38, and derivatives pressure is cooling. Still, the descending channel remains in place, capping momentum. Buyers have marginal control, but trend strength hasn’t arrived yet.

For ADA to shift into a sustained advance, price needs a decisive break above channel resistance. Until that happens, patience matters. The groundwork is being laid, but structure will decide whether this accumulation phase turns into something bigger, or just another pause.