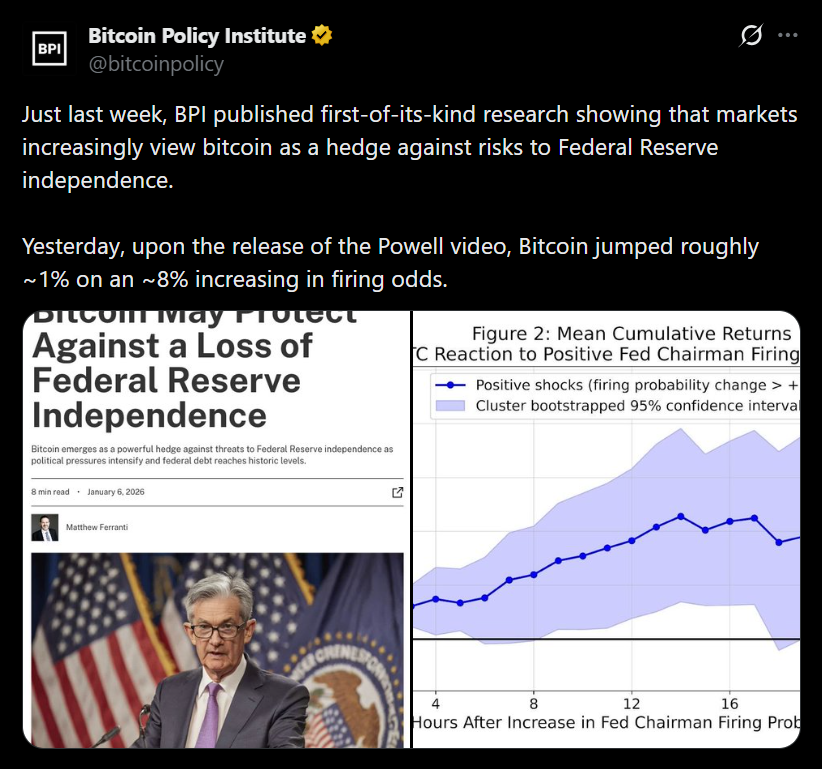

- Institutions are reframing Bitcoin as insurance against governance risk.

- Its appeal centers on fixed rules and independence from political control.

- Bitcoin is being positioned as a hedge alongside, not instead of, fiat systems.

The way institutions talk about Bitcoin has shifted, and it’s subtle but important. It’s no longer framed mainly as a high-risk growth trade or a leveraged bet on tech optimism. Instead, it’s increasingly discussed as insurance. Not against inflation in the traditional sense, but against governance risk. When large allocators describe Bitcoin today, they focus less on upside and more on what it isn’t — not issued by a state, not adjusted by committees, and not dependent on political stability to function.

Why Non-Sovereign Assets Are Suddenly Attractive

Institutions value predictability, and lately that’s been in short supply. Policy reversals, emergency fiscal measures, regulatory uncertainty, and visible pressure on central bank independence have forced allocators to think in scenarios rather than forecasts. Bitcoin fits neatly into that framework. Its monetary policy is fixed, its supply is transparent, and its rules don’t change with leadership cycles. For those managing tail risk, that reliability matters more than debates around payments or adoption curves.

A Parallel Hedge, Not a Fiat Rejection

This shift doesn’t mean institutions are abandoning fiat systems. They still operate within them and rely on them daily. Bitcoin is increasingly viewed as a parallel hedge, much like gold sits alongside cash and bonds. The difference lies in portability, instant verifiability, and the absence of sovereign strings. When political risk becomes part of the monetary equation, assets without discretionary control start to look less speculative and more strategic.

Trust, Not Price, Is the Core Driver

Bitcoin’s growing institutional appeal isn’t really about price targets anymore. It’s about trust, or more accurately, where trust is thinning. As uncertainty around policy, regulation, and governance continues to surface, capital looks for assets that exist outside those systems. Bitcoin’s non-sovereign nature is no longer a slogan or philosophical stance. For many institutions, it’s the entire point.