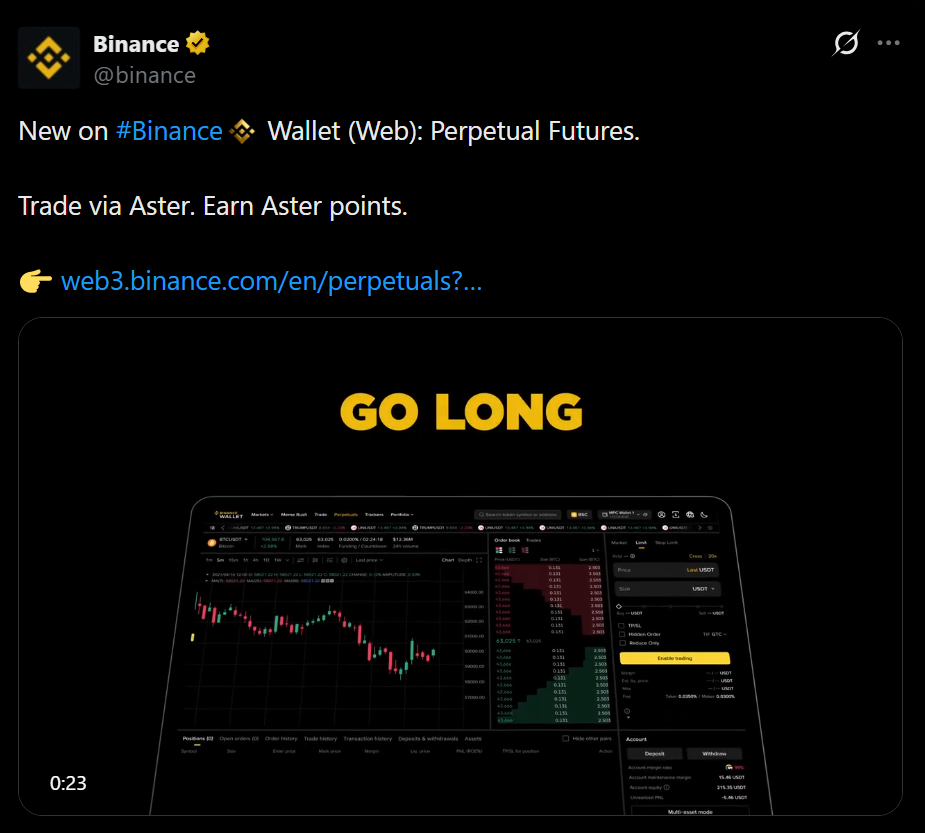

- Binance Wallet now supports on-chain perpetual futures trading via Aster.

- Users trade with self-custody while accessing crypto and stock perpetuals.

- A launch campaign offers rewards and airdrop incentives for early traders.

Perpetual futures trading has officially landed inside Binance Wallet, giving users a new way to access on-chain derivatives through Aster without giving up control of their assets. The setup is fully self-custodial and keyless, meaning traders can stay in control while still tapping into advanced derivatives markets. It’s a subtle change on the surface, but it marks a deeper push toward blending serious trading tools with decentralized custody.

On-Chain Perps With Familiar Trading Flexibility

The service is rolling out first on BNB Smart Chain and is accessible directly through Binance Wallet. Users can trade perpetual futures using multiple collateral tokens, lowering friction for those already active on-chain. What stands out is the range of markets available — not just crypto perpetuals, but also stock-based perps tied to names like Apple and Nvidia. That mix hints at where on-chain trading is headed, pulling in assets traditionally locked inside centralized platforms.

Infrastructure, Liquidity, and Privacy Built In

Aster’s trading engine brings deep liquidity, transparent mark pricing, and infrastructure designed to handle high-volume activity without sacrificing clarity. Privacy-enhancing features add another layer of appeal for traders who want performance without excessive exposure. Combined with Binance Wallet’s interface, the experience feels closer to centralized trading — just without the custody trade-offs.

Rewards, Airdrops, and Trading Incentives

There’s also a clear incentive push behind the launch. Trades executed through Binance Wallet will earn points toward Aster’s airdrop program and count toward future trading competitions and reward initiatives. To kick things off, Binance Wallet is running a dedicated campaign offering up to 200,000 USDT in rewards, adding a short-term boost for early adopters.

What This Signals for DeFi Trading

This launch shows how fast the line between centralized convenience and decentralized control is fading. By embedding perpetual trading directly into a self-custodial wallet, Binance and Aster are betting that traders want both power and ownership — not one or the other. If adoption follows, on-chain derivatives could move from niche to default faster than many expect.