- Recent crypto ETP outflows are tied to shifting rate expectations.

- Uneven flows across assets point to rotation, not panic.

- Crypto is now traded as a macro asset within institutional portfolios.

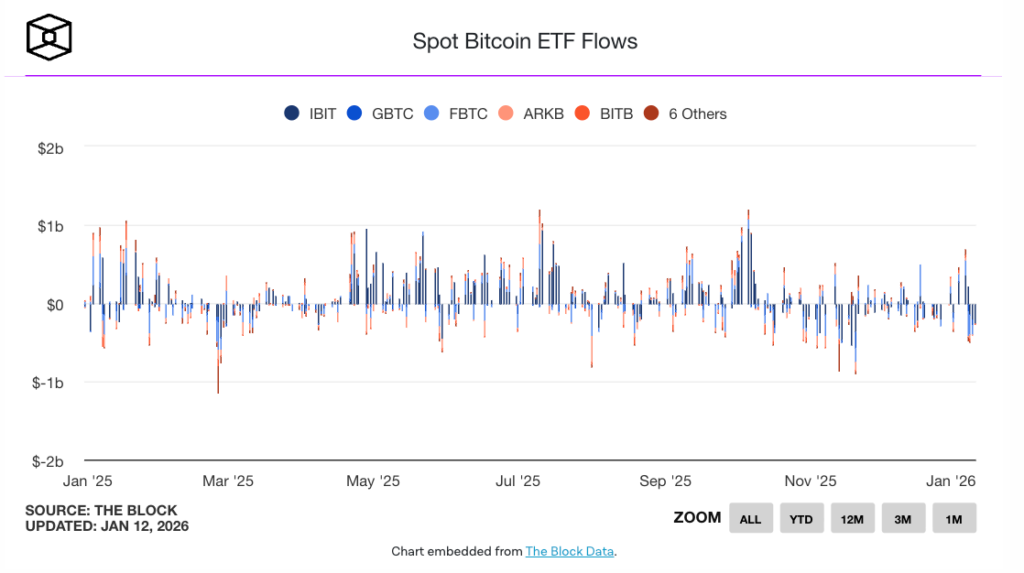

Headlines love big red numbers. Hundreds of millions leaving crypto ETPs looks alarming if you stop there. It reads like confidence is cracking or that something fundamental inside crypto is breaking. That’s the wrong read. What’s happening has far more to do with interest rates than belief in digital assets.

This Is a Rates Story, Not a Crypto One

The timing is the giveaway. The outflows line up almost perfectly with markets dialing back expectations for near-term Federal Reserve rate cuts. When that happens, macro capital adjusts everywhere at once. Crypto ETPs sit alongside equities, bonds, and commodities in institutional portfolios. When short-term yields start looking attractive again, risk exposure gets trimmed across the board.

That tells you exactly who’s moving. This isn’t long-term conviction selling. It’s professional money reacting to policy signals, doing what it always does.

Uneven Flows Are the Real Signal

If this were fear-driven, money would leave everything equally. That didn’t happen. Bitcoin and Ethereum products saw redemptions, but Solana, XRP, and Sui still pulled in capital. That’s rotation, not retreat. Investors are staying involved, just being more selective about where they want exposure.

Even geographically, the story splits. The U.S. accounted for most of the outflows, while Europe and Canada continued allocating. That points to differences in rate sensitivity and positioning, not a global loss of confidence in crypto.

What This Says About Crypto’s Maturity

Crypto isn’t being treated like a fringe asset anymore. It’s being traded like a macro position. When rate cut hopes fade, exposure shrinks. When those expectations return, capital can flow back just as quickly. That’s not weakness. That’s what integration into traditional portfolios actually looks like.

Conclusion

The mistake is reading ETP outflows as a verdict on crypto itself. They’re a reflection of macro positioning, nothing more. Miss that context, and the story looks scary. See it clearly, and it looks like a market that’s grown up.