- Bitfarms exiting Paraguay reflects capital chasing higher-density compute returns, not mining weakness.

- North America’s advantage comes from aligned power, regulation, financing, and AI demand.

- Bitcoin mining is evolving into foundational infrastructure for future compute workloads.

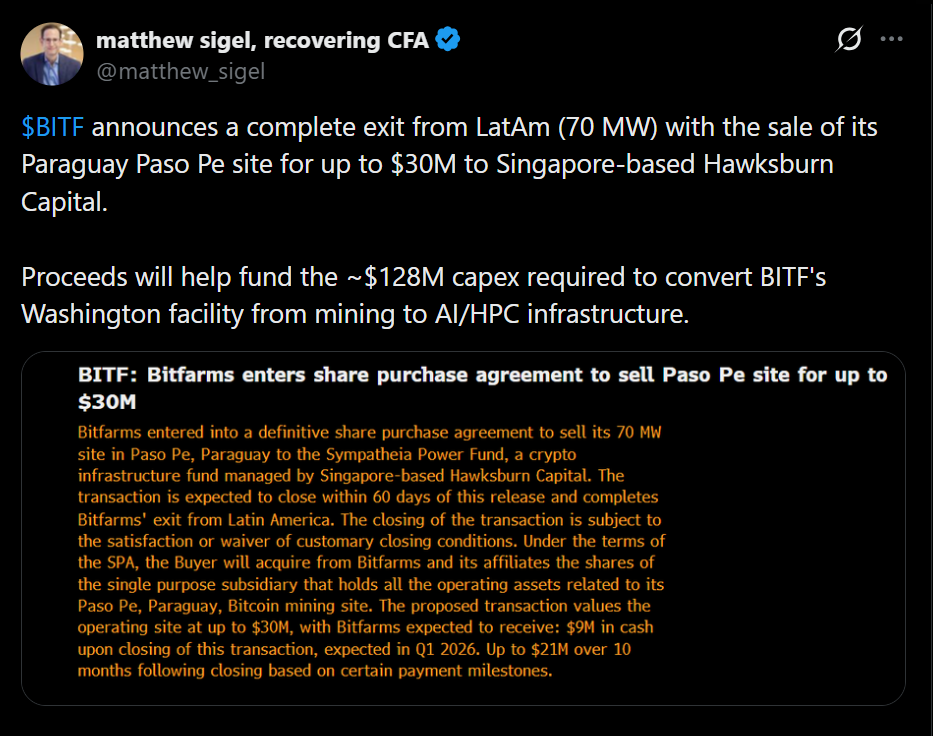

Bitfarms selling its Paraguay mining site sounds dramatic if you stop at the headline. An exit from Latin America. A tighter focus on North America. But when you zoom out, this looks less like a retreat and more like a disciplined capital decision. AI and high-performance computing are pulling in capital at a pace bitcoin mining can’t currently match. When an asset can be monetized today and recycled into infrastructure with denser returns and longer contracts, the math becomes hard to ignore.

Bitcoin mining is still profitable. It’s just no longer the highest bidder for electrons in certain markets, and capital tends to follow whoever is paying the premium.

Why North America Keeps Winning the Capital Race

The advantage North America has right now isn’t just scale, it’s coordination. Power markets, regulation, financing, and enterprise demand are aligned in a way that favors large compute deployments. AI workloads want predictable pricing and long-term certainty. Utilities prefer stable, creditworthy counterparties. Governments want data centers built onshore. When those incentives line up, capital moves quickly and decisively.

In that environment, mining becomes optionality, not the end goal. Compute capacity becomes the prize. Bitfarms isn’t walking away from energy. It’s leaning into energy assets that can serve more than one purpose.

Paraguay Didn’t Fail, It’s Just Early

Paraguay didn’t suddenly become unattractive. Cheap hydroelectric power, excess capacity, and grid stability are still there. What’s missing is proximity to hyperscale AI demand and the financial plumbing needed to support massive, long-duration compute leases. That doesn’t make Paraguay obsolete. It makes it early.

Over the longer term, regions like Paraguay may act as reserves rather than front-line markets. Bitcoin mining can absorb surplus energy, justify grid expansion, and keep infrastructure warm. When global compute demand eventually spreads beyond North America, those regions won’t be starting from zero. They’ll already be proven.

Mining Is Becoming the On-Ramp to Compute

What we’re watching is bitcoin mining maturing into a feeder industry for compute infrastructure. Sites get built for mining, validated for uptime and energy performance, then repurposed when higher-value workloads arrive. That’s not failure. That’s graduation. Mining de-risks the asset, compute monetizes it further.

Why This Matters Going Forward

Bitfarms didn’t abandon Paraguay. It monetized timing. North America gets the spotlight for now because that’s where demand is densest and contracts are richest. But the energy story doesn’t end there. Bitcoin mining is becoming the base layer, the proving ground. AI is simply renting the penthouse above it.